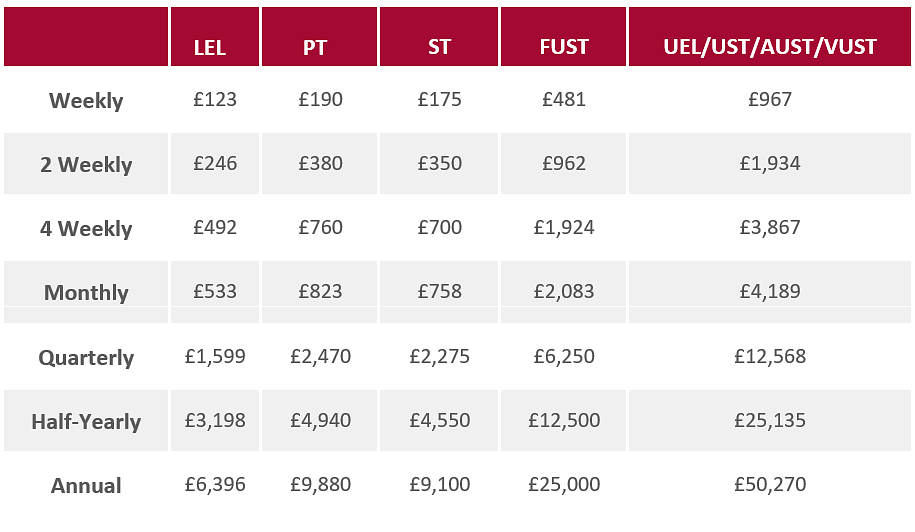

Earnings Thresholds

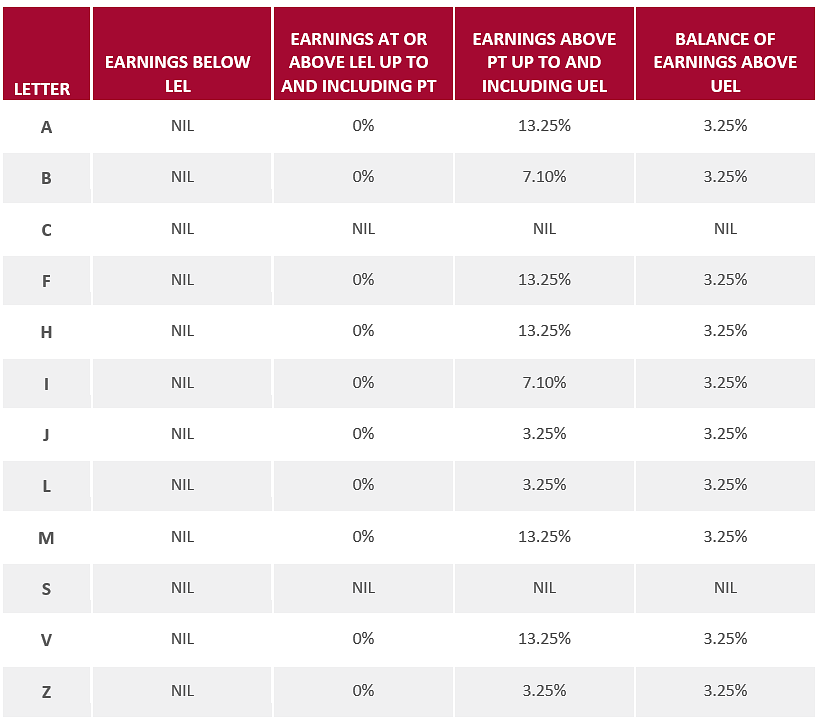

Employee Contributions

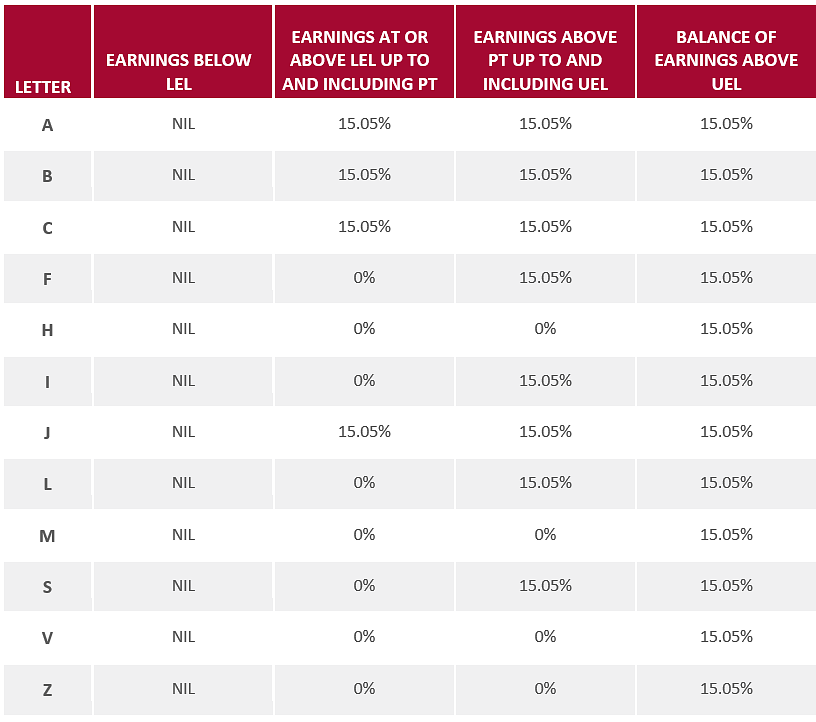

Employer Contributions

Glossary

LEL – Lower Earnings Limit

PT – Primary Threshold

ST – Secondary Threshold

FUST – Freeport Upper Threshold

UEL – Upper Earnings Limit

UST – Upper Secondary Threshold

AUST – Apprentice Upper Secondary Threshold

VUST – Veterans Upper Secondary Threshold

NI Category Letters

A – All not covered by another category

B – Married women and widows entitled to pay reduced NI

C – Employees over state pension age

F – Freeport standard

H – Apprentice under 25

I – Freeport married woman’s reduced rate election (MWRRE)

J – Deferment

L – Freeport deferment

M – Under 21

S – Freeport over state pension age

V – Veterans standard

Z – Under 21 deferment

If you are interested in doing business in the United Kingdom, find out everything you need to know about payroll, tax, social security, employee benefits, work permits, employment law and more in activpayroll’s Guide to Doing Business in the UK. This is available as a free PDF to download.