Measure 1

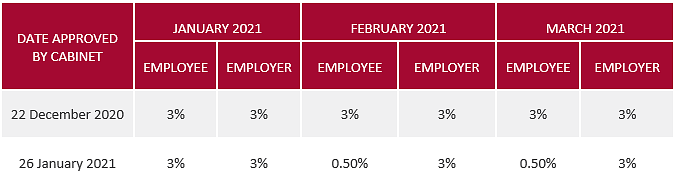

Social Security Fund contributions will be further reduced for employees in February and March 2021 from 3% to 0.5%. This reduction is based on wages capped at 15,000 baht, this means employees will make contributions of between 8 - 75 baht.

Measure 2

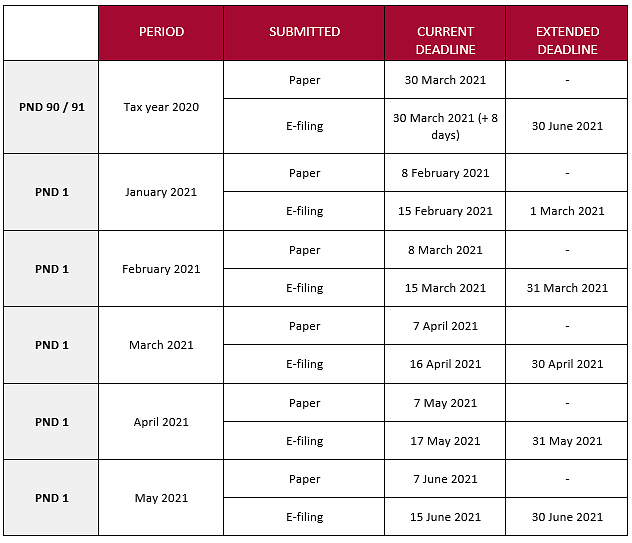

The deadline for electronically filing personal income tax returns (Forms PND 90 / 91) has been extended from 31st March 2021 to 30th June 2021. Despite the extended deadline, the option of paying tax in three monthly installments is still available.

The deadline for electronically filing monthly withholding income tax returns (Form PND 1) for the period January 2021 – May 2021 has been extended to the end of the following month (February 2021 – June 2021), respectively.

For more information on Thailand’s tax and payroll landscape, browse activpayroll’s Global Insight Guide to Thailand.

For more information and guidance on coronavirus support measures for businesses, employers and employees, visit the activpayroll latest news page.