When scaling a global business, there are international regulations that if ignored, slow HR and payroll teams down and cause employee inaccuracies that can result in fines. If compliance requirements are not met and deadlines are missed, a huge strain can be put on cross-border teams.

Common issues include people data inaccuracies, errors caused by multiple workforce systems and manual admin tasks, as well as a lack of understanding of nuanced payroll requirements in individual countries. This is especially true as a business enters new regions with complex challenges like employer tax, staff remuneration or payment legislation. Thankfully, there are payroll solutions available to help ensure people teams have visibility over global employee data to ensure compliance, establish operational efficiencies, and reduce business expenditure caused by a lack of automation and visibility.

What is a global payroll solution?

Global payroll solutions and services reduce employee data inefficiencies caused by a lack of clarity when crossing borders with your business. Secure and reliable technology that can consolidate, manage, collate and process all your payroll and employee data on time, helps transform businesses looking to scale.

Localised customer support and mobility services work with one payroll platform, empowering employees to work anywhere. Payroll solutions provide solutions that navigate complex regulatory challenges businesses face when looking for global expansion in regions with evolving regulations.

Securely managed and processed employee payroll data

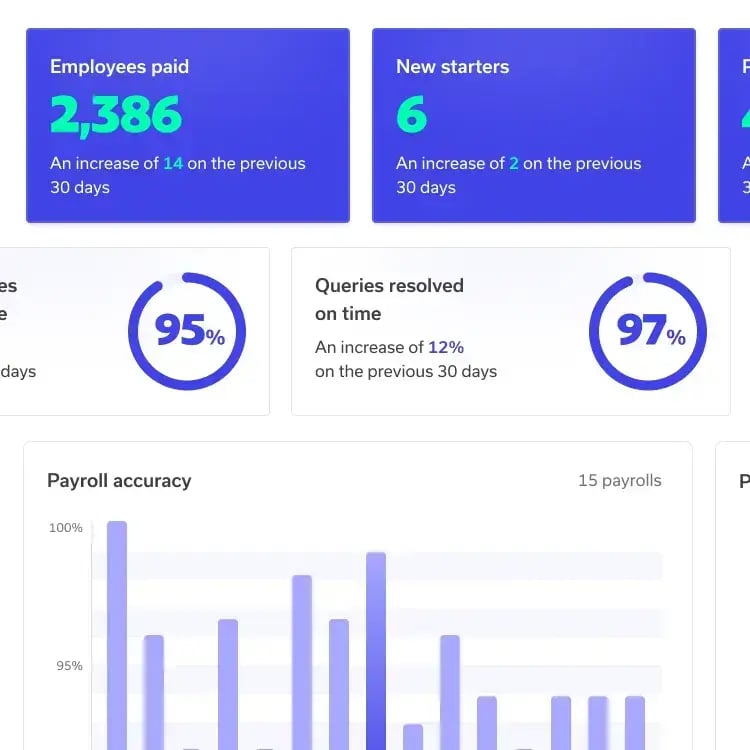

End-to-end solutions and services provide payroll transparency, delivering clarity to drive better payroll performance. More access, control and management of payroll data on one platform that notifies your team of any requirements, validates reports for compliance and supports timely payment. Task automation and local expertise ensures employees are paid on time and that international business operations run smoothly.

Global payroll solutions also help establish best practices and working processes that assist businesses with workforce system integration and one data driven software that gives more control and oversight over employees. Local payroll experts can be placed on the ground, ready and on hand to navigate teams through the challenges of international business operations, whatever the location.

3 global payroll services that help businesses grow globally:

- Payroll

- Human resources

- Mobility

Global payroll

Global payroll is a secure and accurate service that enables businesses to confidently operate across multiple countries and regions. Collate, manage and distribute your people data for payroll processing with full visibility and enjoy validated reporting that saves time and delivers value-driven outcomes for your international employee workforce.

activ8 is a secure global solution that gives businesses full control of their bespoke payroll management system. Innovative software helps to keep track of all payment transactions, but it can also be seamlessly integrated into an existing system, unifying data platforms and automating time-consuming processes.

Global mobility services

Whether employee structuring, cost analysis or double tax treaty guidance is required, global mobility facilitates business accuracy, ensuring operational efficiencies are met. Tracking systems include analytics that allow teams to manage people payments with clarity.

Policy frameworks, advisory teams and payment planning make sure immigration frameworks and employment law are understood and complied with to keep global businesses mobile. Mobility provides guidance with tax compliance, policy design and staff review. Navigate the complexities of international cost analysis, policy, remuneration, tracking and managing the movement of employees efficiently and within compliance of local regulations.

Global HR services

End-to-end payroll management helps establish a rounded understanding of cross-country operations. Local experts are located and available across several regions, helping to simplify expansion into new territories with guidance that goes beyond successful setup in a new country with ongoing support at each point of the payroll process. Local experts can come as part of a mobility and payroll service, ensuring accurate execution that meets all regulatory demands, as well as assisting with tax incentives or requirements. If you don’t have boots on the ground, a team can be there on your behalf.

Transformative end-to-end global payroll support

An international payroll platform that can monitor, collate, manage and process doesn’t have to be complicated—but it does need to comply with international laws and achieve compliance to avoid fines or government action.

Real-time solutions and people services are designed to remove workforce confusion, streamline tasks, reduce administrative errors and empower people to get mobile. Looking to scale your business in new international regions?

Our global team are available to offer a live demonstration and talk with you about what activpayroll can do to help grow your business and streamline operations that can result in significant cost-savings. Speak with a specialist today to learn more about our global services.