What will change from 1 July 2021?

From 1 July 2021, the level of grant will be reduced and employers will be asked to contribute towards the cost of furloughed employees’ wages. To be eligible for the grant, employers must continue to pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they spend on furlough.

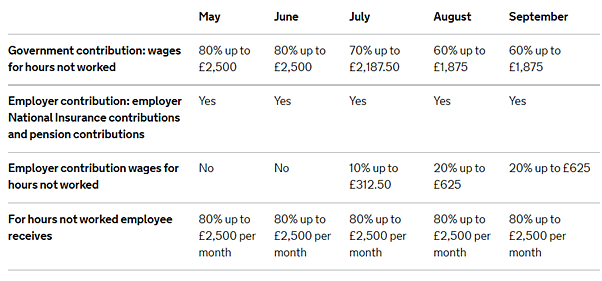

The table below displays the level of government contribution available in the coming months, the required employer contribution and the amount that the employee receives per month where the employee is furloughed 100% of the time. Wage caps are proportional to the hours not worked.

Employers can continue to choose to top up employees’ wages above the 80% total and £2,500 cap for the hours not worked at their own expense.

For more information on coronavirus support measures for employers and employees, please visit out Latest News page. For further advice on the furlough scheme, please visit the Government website.