Our guide to Payroll in China

With liberalisation measures stimulating growth and opening the country to investment, China has become the second-largest economy in the world: in 2024 its GDP stood at an estimated $18.7 trillion.

Unlock China’s payroll, income tax, social security, and employment law essentials. Get the latest updates for businesses operating in this dynamic market.

1. Introduction to Our guide to Payroll in China

2. Setting Up a Business

3. Employment Practices

4. Taxation & Social Security

5. Payroll Operations

6. Hiring & Termination

7. Compensation & Benefits

8. Visas & Work Permits

9. Location-Specific Considerations

1. Introduction to Our guide to Payroll in China

Doing Business in China

Investing in China

China’s economic reforms were designed to increase consumerism and serve a growing middle class, but foreign investment can still be a constantly changing process. Depending on the desired market, access can be easily achieved, or completely refused - and each case must be considered on an individual basis. That said, many of China’s industries are benefiting international business, including products from a range of manufacturing sectors, and the mining industry. Initiatives like the establishment of the Shanghai Free Trade Zone represent a bold step by the Chinese government to introduce new levels of FDI to the country.

Basic Facts about China

General Information:

Full Name: People’s Republic of China

Population: 1.409 billion (World Bank, 2024)

Capital: Beijing

Primary Language: Mandarin

Main Religion: Buddhism, Christianity, Islam, Taoism

Monetary Unit: Yuan

Main Exports: Electrical machinery and equipment, furniture, cotton, tea and rice

GNI Per Capita: US $13,660 (World Bank, 2024)

Internet Domain: .cn

International Dialling Code: +86

How to say: -

Hello: 你好

Good morning: 早安

Good evening: 晚上好

Do you speak English? 你会讲英语吗?

Good bye: 再见

Thank you: 谢谢

See you later: 回头见

Dates & Numbers

Dates are usually written in the year, month and day sequence.

Example: 2025/07/08

2. Setting Up a Business

Registrations and Establishing an Entity

The company is required to have a legal entity established in order to process a payroll. They require an entity before they sign the labour contract with the employees.

Foreign employers can register the following entities in China:

-

Representative Office (RO): Registration time is around two months.

-

Wholly Foreign Owned Enterprise (WFOE): This is a form of limited liability company in China. The registration time is around three months.

Banking

It is mandatory to make payments to both employees and the authorities from an in-country bank account. In general, the opening hours for banks in China are 0900-1700. Banks are closed on Saturday and Sunday.

3. Employment Practices

Working Week

The working week in China is Monday to Friday. General opening hours for commercial offices are 0900-1200 and 1300-1800.

Employment Law

Holiday Accrual / Calculations

The statutory annual leave entitlement is generally based on an employee’s work experience/ tenure. Employers may extend paid annual leave entitlement as an additional benefit to their employees.

Employees who have worked at a company for one continuous year are entitled to five days annual leave. Thus, employers do not have to give leave to employees who have not yet worked for one full year.

|

Statutory annual leave |

|

|

Work Tenure |

Days Leave |

|

Less than one year |

0 |

|

1 – 10 years |

5 |

|

10 – 20 years |

10 |

|

Over 20 years |

15 |

It is important to note that the work tenure is not limited to the length of time an employee has worked for their current employer, but rather refers to their cumulative work experience with all previous and current employers.

Maternity Leave

Maternity leave entitlement is up to 128 or 158 days after the birth, depending on province.

Paternity Leave

Paternity policies vary vastly across China, especially when operating in a different province. Paternity leave length and pay is determined by location of employment, and can also be subjected to the company policy. There are no existing paternity leave policies for foreign workers in China; whether or not paternity leave can be taken is therefore at the discretion of the employer.

Sickness

Sick leave entitlement will depend on the following factors:

- Total number years of the service

- Years of working history in the current organization

4. Taxation & Social Security

Tax & Social Security

The tax year runs from 1 January to 31 December.

Individual Income Tax (IIT): The employee has the duty for tax filing every month.

Each city/region has a Tax Bureau and Social Security Bureau that can be contacted for more information.

Monthly individual income tax is usually paid by the 15th of the following month except for special months due to public holidays, which the tax bureau will postpone the due date of the tax payment.

The penalty for late payment of individual income tax is 5/10000 of the amount owed per day.

Standard Deduction

Effective as of 1 October 2018, the standard deduction on comprehensive income is RMB 5,000 per month for both resident and non-resident taxpayers.

Monthly Tax Calculation

According to the new tax regulations effective from January 1 2019, the monthly individual income tax = cumulative tax payable – cumulative tax withheld in previous period.

[Cumulative tax payable = cumulative taxable income × withholding rate – quick deduction

Cumulative taxable income = cumulative income (excluding tax-exempt income) – cumulative applicable deductions (including personal deduction, special deductions, itemized deductions and other applicable deductions)]

Social Security

There are two mandatory statutory contributions, outlined below.

China’s standard social security scheme comprises a system called the “Five Insurances” – the basic pension, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance. Contribution to China’s social security system is mandatory for Chinese employees and their employers as well as foreigners employed in China. The social security contribution is calculated as a percentage of employees’ monthly salary, which is subject to lower and upper cap. The caps are adjusted every year.

Both employers and employees are required to make contributions (actual rates differ per city or province) to the following funds:

|

Employee Contribution |

Employer contribution |

|

|

5. Payroll Operations

Payroll

Reports

Payroll reports must be kept for at least five years.

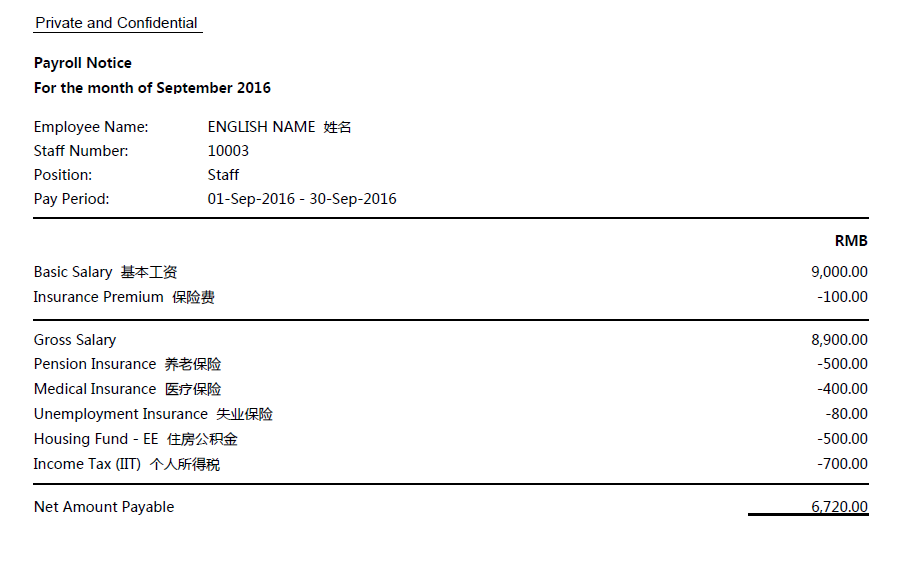

Payslip Example

It is legally acceptable in China to provide employees with online payslips.

6. Hiring & Termination

New Employees

When a new employee starts, he/she must be registered with the Social Security Bureau. Registration will be done by the employer or agent before the 15th of the current month if hired before the 15th.

When setting up a new start, the following information is required:

- Employee information

- Monthly salary, start date

- Location of contributing social security and housing fund

When setting up an expat, the following additional information is required:

- Passport

- Work permit

Registration for an expat will be done by the employer or agent before the 15th of the current month if hired before the 15th.

Leavers

Payment for leavers will usually be made before the regular payment date. The authorities do not have to be notified of a leaver.

Minimum Wage

|

City |

Minimum Wages |

Effective Date |

|

Beijing |

2540 / month |

1 September 2025 |

|

Shanghai |

2740 / month |

1 July 2025 |

|

Shenzhen |

2520 / month |

1 March 2025 |

7. Compensation & Benefits

Employee Benefits

All expenses are tax deductible if official receipt (fapiao) is provided.

8. Visas & Work Permits

Visas & Work Permits

Employment Visa (Z visa)

It is necessary for anyone who would like to work in China to obtain a China Visa. They must obtain a China Visa whether or not they bring their family with them. This China work permit must also be obtained if providing commercial entertainment in China. In both cases, it is necessary that the sponsoring employer meet the obligatory expectations.

To be issued with a China Visa, an individual must be considered a foreign expert/have a particular sought-after skill. The company sponsoring the employee must have a certificate to prove this.

The company sponsoring the employee will fulfil its side of the bargain to help the employee get a China Z Visa by giving the employee an employment permit (which is provided by the country’s government) as well as a visa notification letter that must be provided to the government (or Global Visas) along with photocopies of the China work visa application. Family members are also allowed to apply for a China Z Visa by showing a certificate indicating their relationship to the applicant, whether they are a wife, husband, or dependent.

The China Visa is only valid for one month or 30 days from when the employee arrives, after which it will expire. The employer must then apply for a Foreign Worker’s permit and a Residence Permit to replace the China Z Visa. Both of which are valid for one (1) year.

9. Location-Specific Considerations

Key changes for 2025 & 2026

Public Holiday Leaves

Employers are required to provide public holidays for employees in accordance with the law. Effective from 2025, China will observe a total of 13 public holidays each year instead of 11 days. These holidays must be arranged by the employer as follows:

|

Public Holiday |

Date |

Days |

|

New Year |

1 January |

1 |

|

Chinese New Year |

Lunar New Year’s Eve – 3th day of the First Lunar Month |

4 |

|

Qing Ming Day |

Seventh Day of the Third |

1 |

|

Labour Day (May Day) |

1-2 May |

2 |

|

Dragon Boat Festival |

Fifth Day of the Fifth Lunar |

1 |

|

Mid-Autumn Festival |

15th Day of the Eighth |

1 |

|

National Day |

1–3 October |

3 |

New Retirement Policy

Starting from 1 January 2025, China implemented a phased increase in the statutory retirement age policy. The retirement age for men will gradually rise from 60 to 63 years. For women, the retirement age will vary based on their position:

-

▪ Female employees in management roles will have their retirement age extended from 55 to 58 years.

-

▪ Female employees or workers in non-management roles will have their retirement age extended from 50 to 55 years.

This policy will be implemented in stages, with full implementation expected by 2040.

Social Benefit and TAX compliance

In 2026, China has significantly tightened compliance enforcement regarding social insurance and individual income tax (IIT) obligations, with authorities implementing rigorous cross-verification mechanisms between tax and social security systems to ensure full compliance.

Key policy highlights include:

-

Mandatory Full-Base Social Insurance Contributions: Employers must strictly contribute to all five social insurances (pension, medical, unemployment, work-related injury, and maternity) plus the housing fund based on employees' actual gross salary rather than negotiated minimum bases, with severe penalties for underpayment or delayed contributions, including late fees and potential blacklisting on corporate credit records.

-

Enhanced IIT Withholding Accountability: Employers bear strict liability for accurate calculation and timely withholding of IIT on comprehensive income (3%-45% progressive rates), requiring monthly remittance to the State Treasury within 15 days; failure to comply now triggers not only financial penalties but also personal liability for responsible executives under revised tax administration protocols.

Expanded Coverage for Foreign Employees: Expatriates working in China are unequivocally subject to both social insurance participation (five insurances) and IIT obligations based on days of physical presence and income sourcing, with data-sharing agreements between immigration, tax, and social security bureaus eliminating previous enforcement gaps.

Digital Compliance Integration: The Golden Tax Phase IV system enables real-time monitoring of payroll data, mandating that employers reconcile social insurance bases with IIT-declared income figures, ensuring total transparency in employment cost reporting and eliminating arbitrage opportunities between different government departments.

Further Information

For more information, or assistance with China Tax inquiries please contact: gi@activpayroll.com

About This Payroll and Tax Overview

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

|

Overcome complexity and achieve compliance to ensure employees are paid on time, every time, no matter the location.