Tax Rates and Bands

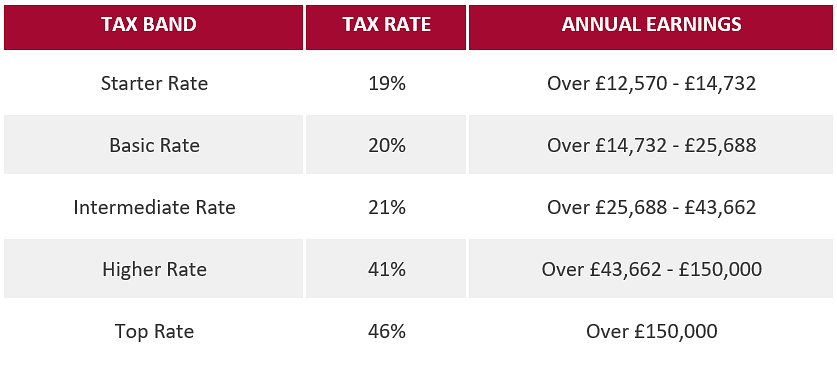

For tax year 2022-23, Scottish income tax rates will remain unchanged, however the Budget confirmed that the ‘starter’ and ‘basic’ rate bands will increase in line with Consumer Price Index (CPI) inflation (3.1%). The ‘higher’ and ‘top’ rate bands will remain frozen at 41% and 46%.

Public Sector and Social Care Hourly Rate Increase

It was announced that the minimum wage for social care staff and people covered by the Public Sector Pay Policy will rise to £10.50 an hour. The Public Sector Pay Policy for 2022 will focus on those on low incomes, ensuring an inflationary uplift of at least £775 for those earning up to £25,000, £700 for those earning between £25,000 and £40,000 and £500 for those earning above £40,000.

More highlights from the Scottish Budget can be found here.

Interested in doing business in the United Kingdom? Find out everything you need to know about payroll, tax, social security, employee benefits, work permits, employment law and more in activpayroll’s Guide to Doing Business in the UK. This is available as a free PDF to download.