India’s state budget for 2020-21 has been announced: businesses should prepare for the tax measures that it introduces.

India’s 2020-21 budget was presented on 20 February, by Minister Ashok Gehlot. The budget was focused on three central ideas: Aspirational India, Economic Development, and A Caring Society, themes accompanied by a range of spending measures. With India’s economy on the rebound, and with a projected growth rate of 6-6.5%, the budget also included a range of income tax measures.

Key tax highlights of India’s 2020 budget are as follows:

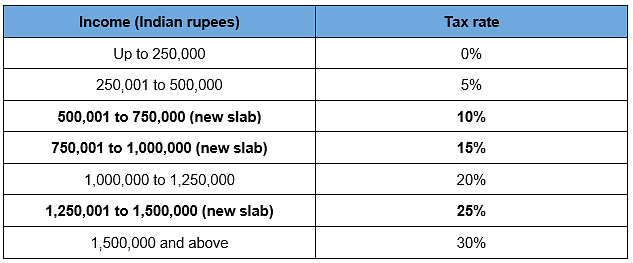

New Income Tax Slabs

While existing tax slabs remain the same, the budget introduces several new optional tax slabs. The new slabs are indicated below:

Optional tax slab conditions: Taxpayers wishing to use the optional tax slabs will not be able to take advantage of a number of exemptions and deductions. In more detail, the following tax exemptions and deductions will not be available:

- Allowances u/s 10(14)

- Allowances for MPs/MLAs S.10(17)

- Allowance for income of minor S.10(32)

- Leave Travel Concession S.10(5)

- House Rent Allowance S.10 (13A)

- Standard Deduction u/s 16

- Interest on housing loan u/s 24 in respect of SOP/Vacant Property. In addition, taxpayers cannot claim any losses from rental income, or carry those losses forward. Loss under head income from House Property for rented houses shall not be allowed to set off and would be allowed to carry forward.

- Any deductions under chapter VIA: this includes S.80C, S.80CCD, S.80D, S.DD, S,80DDB, S.80E, S.80-EE, S.80EE, S.80EEA, S.80EEB, S.80G, S.80TTA/B, S.80U.

- Exemptions for free food and beverage vouchers provided to employees by employers.

Certain exemptions to the optional tax slab conditions have been made. Taxpayers are allowed to claim the following deductions and allowances:

- Employer’s contribution to the National Pension Scheme

- Rebate u/s 87A.

- Transport allowances incurred in performing work duties, allowances used to meet the cost of work travel, or daily allowances incurred on a work trip

Additional income tax measures: The budget includes a number of additional tax measures:

- The exemption for senior citizens remains at 3 Lakhs, while the exemption for very senior citizens remains at 5 Lakhs. Available only in case of old tax regime, no beneficial exemption slab in new tax regime for senior citizens.

- The 4% Health & Education Cess remains in place.

- The S.87A tax rebate up to Rs.12,500, available to individual taxpayers with income under Rs.5 Lakh remains in place.

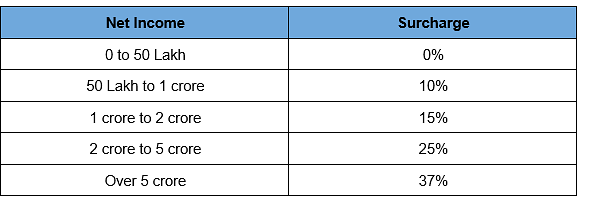

The income tax surcharge is set as follows:

Standard Deduction: The Standard Deduction (under S.16) of Rs.50,000 remains in place for existing tax rates but is not available for taxpayers who opt for the new tax slabs.

Taxable Prerequisites: Employer contributions over Rs.7.5 Lakhs to an employee’s recognised provident fund, approved superannuation fund, or to the National Pension Scheme are now considered taxable prerequisites. It is also proposed that any annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the fund or scheme may be treated as perquisite to the extent it relates to the employer’s contribution which is included in total income.

Loan Sanction Periods: The sanction period for tax deductions of loans taken out for residential house properties (u/s S.80EEA) has been extended to 31 March 2021.

Determining Residential Status

The budget includes measures for determining the tax residency of Indian citizens. A citizen of India would be deemed to be a resident of India in any financial year, if such individual is not liable to tax in any other country on account of his domicile, residence, or any other criteria of a similar nature. Under current rules, Indian citizens can be considered tax residents if they spend more than 182 days in India during the financial year, and are not liable to pay income tax in any other country. Under an amendment in the 2020-21 budget, an individual is considered a tax resident if:

- Their stay in India during the financial year is at least 182 days, or

- Their stay in India is over 120 days in the current financial year and at least 365 days in the last 4 financial years.

Indian citizens are considered not ordinarily resident (NOR) if they have not been resident in India for 7 out of the last 10 financial years.

Taxation of ESOP Prerequisites for Start-Ups

Under the 2020-21 budget, start-ups that offer employee stock option plans (ESOP) must pay tax on those plans within 14 days of,

- The 5-year period after the financial year in which the options plan was exercised, or

- The date on which the employee sold their ESOP, or

- The date on which the employee ceased their employment (if that is earlier).

Dividend Distribution Tax

The budget makes provisions to remove the Dividend Distribution Tax (DDT) payable by companies. Under the new regime, the dividend tax will be levied from its recipient taxpayers, at the rate of tax normally applicable to them.

Taxpayer Dispute Waiver

The budget includes a proposal for a waiver scheme for taxpayers who are in dispute with India’s tax authority and are awaiting an appeal. The proposal suggests that the taxpayers pay only the originally disputed amount of tax, with a waiver for any interest or penalty fines imposed, as long as payment is made by 31 March 2020. After that date, taxpayers can still take advantage of the scheme until 30 June 2020 but may have to pay some additional amount.

PAN Allocation through Aadhar

The budget proposes to instantly allocate personal account numbers (PAN) to taxpayers on the basis of their Aadhar number in order to add efficiency to the tax process and remove the need to complete detailed application forms.

Learn more about India’s tax system with activpayroll’s Global Insight Guide to India: the insight guide also includes information on India’s global economic profile, important industrial sectors, and common business practices.