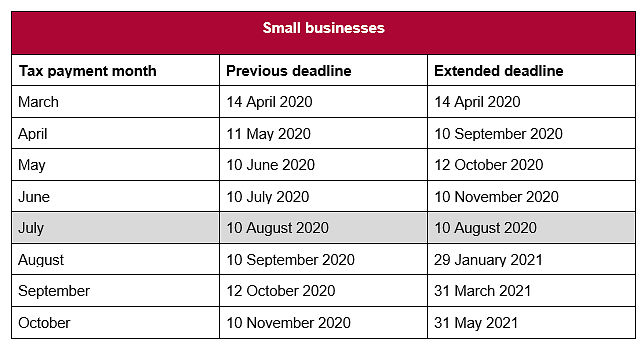

In order to help businesses maintain cash-flow and liquidity during the coronavirus crisis, the Danish government has introduced measures to postpone the payment of withholding taxes for April, May, and June. Earlier this month, the government announced an extension to the scheme, adding the payment months of August, September, and October to the months in which it will be possible for businesses to postpone their payments. July is not included in the extension.

Employers should note that the measures only apply to the payment of withholding taxes and do not exempt them from submitting payroll reports under the pre-existing deadlines.

The postponed deadlines for the payment of withholding taxes vary depending on the size of the business, and are as follows:

For more information on Denmark's labour laws, tax, and payroll landscape, browse activpayroll’s Denmark Global Insight Guide: find background on Denmark's global economic profile, major industrial sectors and common business practices.

Keep up to date with global coronavirus support measures for employers and employees on activpayroll’s news page.