Our guide to Payroll in Denmark

The Danish Government welcomes inward investment, providing various incentives to foreign multinational countries. Denmark has an established infrastructure and provides political stability, making it an attractive country for business investment and expansion.

Being one of the most economically stable countries, keep informed on all Denmark’s payroll & labour laws to help you stay compliant in all your HR processes.

1. Introduction to Our guide to Payroll in Denmark

2. Setting Up a Business

3. Employment Practices

4. Taxation & Social Security

5. Payroll Operations

6. Hiring & Termination

7. Compensation & Benefits

8. Visas & Work Permits

9. Location-Specific Considerations

1. Introduction to Our guide to Payroll in Denmark

Doing Business in Denmark

Denmark is recognised as one of the most politically and economically stable countries in Europe. The government actively welcomes foreign investment, offering incentives across key sectors such as green energy, biotechnology, and information technology. Denmark's efficient infrastructure, highly educated workforce, and strong digital governance make it an attractive destination for international businesses.

Basic Facts about Denmark

|

Full Name |

Kingdom of Denmark |

|

Population |

5.947 million |

|

Capital |

Copenhagen |

|

Major Language(s) |

Danish |

|

Major Religion(s) |

Christianity |

|

Monetary Unit |

Danish Krone |

|

Main Exports |

Machinery, foodstuffs, pharmaceuticals |

|

GNI Per Capita |

US $62,660 |

|

Internet Domain |

.dk |

|

International Dialing Code |

+45 |

Common Phrases

Hello: Hej

Good Morning: Godmorgen

Good Evening: Godaften

Do you speak English?: Taler du engelsk?

Goodbye: Farvel

Thank you: Tak

See you later: Vi ses senere

2. Setting Up a Business

Registrations and Establishing an Entity

All companies must register with the Danish Commercial Agency (Erhvervsstyrelsen). The process typically takes 6 to 8 weeks and results in the issuance of a CVR number. Applications are submitted online and supported by a registration certificate. Entities must obtain a Mit-ID digital signature to interact with public authorities. Foreign service providers must also register in the RUT system and contribute to relevant labour market funds.

Banking

While it is not mandatory to pay employees or authorities from a local bank account, many companies choose to open one with institutions like Danske Bank or Nordea. Standard banking hours are 0900–1600 Monday to Friday.

3. Employment Practices

Working Week

The working week in Denmark is typically Monday to Friday, with a standard range of 37 to 40 hours. Office hours generally run from 0800 or 0900 to 1600 or 1700, with lunch breaks of 30 to 60 minutes.

Employment Law

Holiday Accrual

Employees are entitled to 25 days of paid annual leave, accrued at 2.08 days per month worked. Under Danish Holiday Act 2020, employees may use holiday days as soon as they accrue them (“concurrent holidays”).

Maternity Leave

Female employees receive 4 weeks of pregnancy leave and 14 weeks of maternity leave post-birth. An additional 9 weeks of parental leave is reserved for each parent, with a further 13 weeks available to be shared.

Paternity Leave

Fathers are entitled to 2 weeks of paid leave following the birth, plus 9 weeks of earmarked leave. They may also share up to 13 weeks of parental leave.

Sick Leave

Employees are eligible for employer-paid sick leave for the first 30 days if they meet qualifying criteria. Thereafter, the State provides benefits. Employers can seek reimbursement from the State for qualifying payments.

National Service

Military service in Denmark is voluntary or compulsory depending on age and selection. The minimum service age is 18.

4. Taxation & Social Security

Tax & Social Security

The tax year in Denmark runs from 1 January to 31 December.

Income Tax

Income is taxed progressively. In 2025, individuals earning above DKK 611,800 will face marginal tax rates up to 52.07%. Tax is made up of:

- Bottom bracket tax: 12.09%

- Top bracket tax: 15%

- Labour Market Tax: 8%

- Municipal Tax (avg.): 25.1%

- Personal allowance: DKK 51,600

Social Security

Denmark's employer contributions include:

|

Contribution Type |

Employer Rate (DKK) |

|

Pension (ATP) |

297/month (max) |

|

Education (AUB) |

3,111/year |

|

Occupational Insurance |

9,640/year (max) |

|

Maternity Fund (Barsel.dk) |

1,548/year |

|

Financing Contribution |

99.25/quarter |

|

Expat Labour Fund (AFU) |

0 |

5. Payroll Operations

Payroll

Payroll runs monthly. Employers must retrieve employee tax cards from the tax authority. Online payslips are mandatory, and records must be kept for five years. If equity is granted, such as shares or warrants, these must be reported separately.

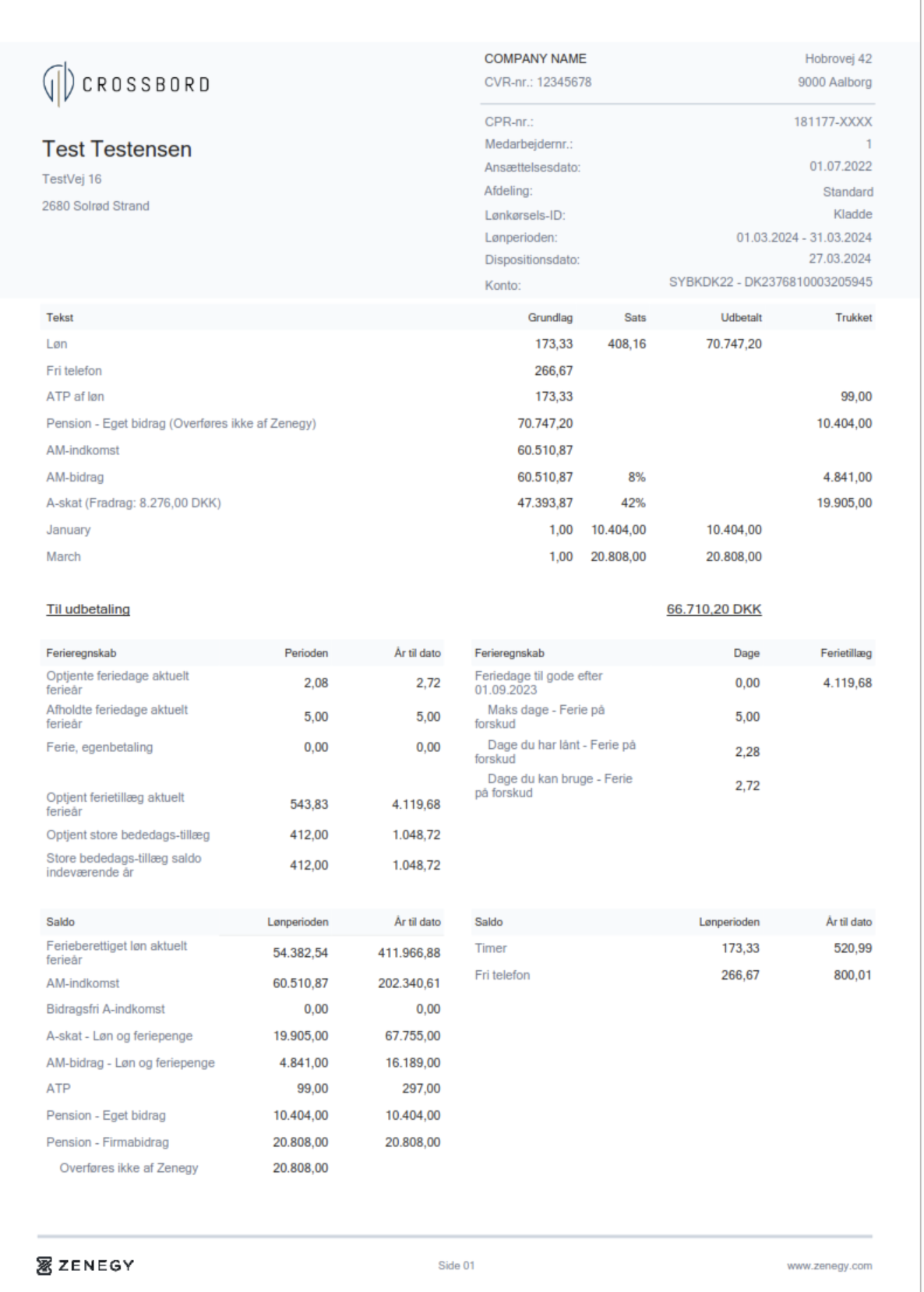

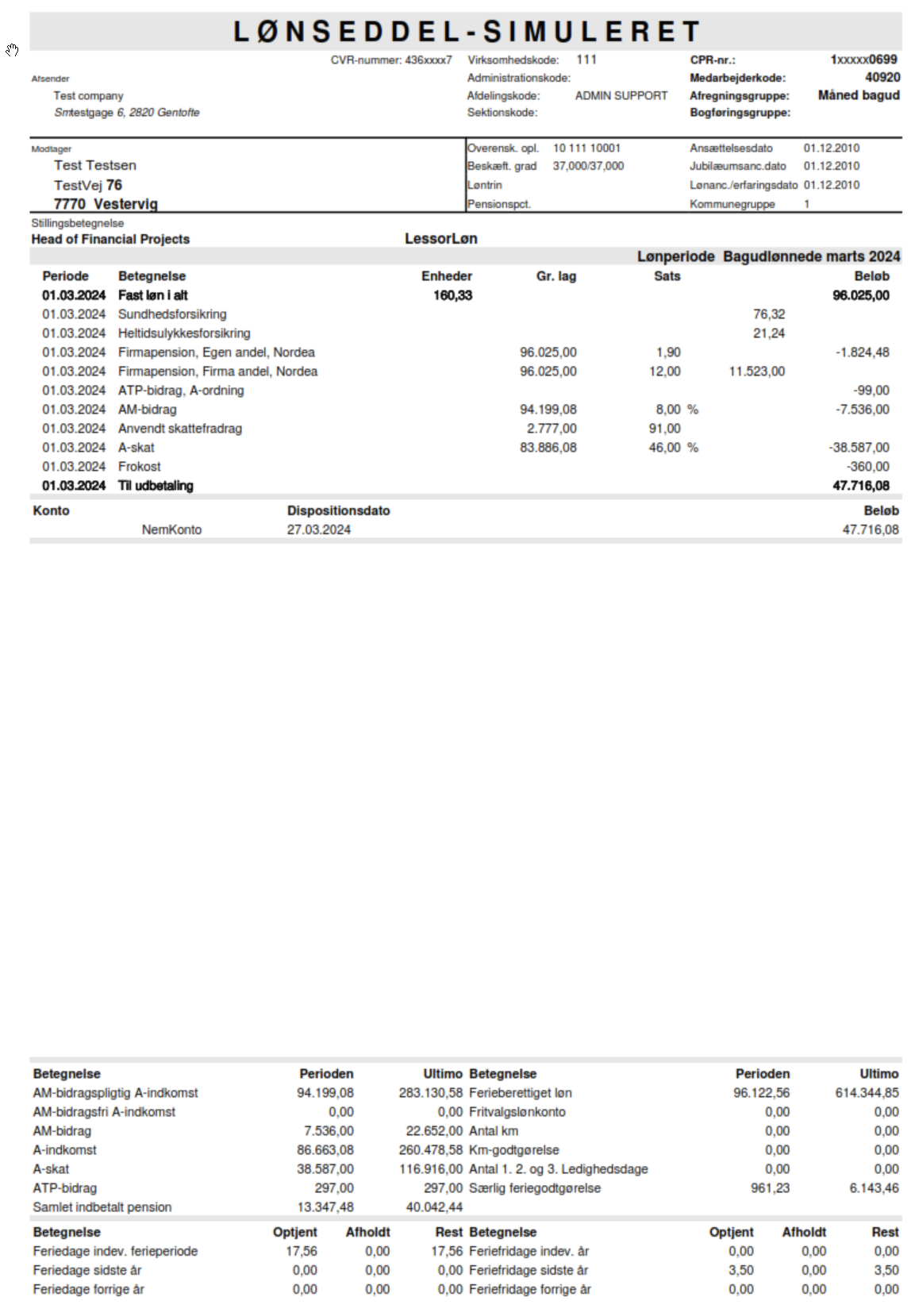

Payslip Example

Reports

Monthly reports are filed through the “E-indkomst” system, which consolidates tax, work time, and social data. There is no annual summary; monthly filings contain all year-end details.

Reporting

Payroll data must be submitted each month to the tax portal. Tax payments are due based on company size—end of month for large businesses, mid-month for small/medium ones.

6. Hiring & Termination

New Employees

New hires must be registered digitally. If the employee is not already known to the Danish tax system, an onboarding form must be submitted. Expatriates must provide passport, visa, marriage certificates, and account details.

Leavers

Upon termination, employers must report and settle accrued holiday with the Holiday Fund (FerieKonto). No additional government notification is required.

7. Compensation & Benefits

Employee Benefits

Employee benefits are taxable once they exceed DKK 1,400 per year, or DKK 7,300 if containing private use. Common taxable benefits include housing, cars, internet, and employer-covered expenses.

Expenses

Benefits like phones and transport may be exempt under certain conditions, but others must be declared as income. Tax is based on the market value unless specified otherwise.

8. Visas & Work Permits

EU citizens can work in Denmark without a permit, but must register if staying beyond three months. Non-EU citizens must apply for a work visa in advance. Approval depends on labour demand and job type. Nordic citizens can work freely without registration. Post-Brexit, UK nationals must obtain permits unless previously registered under EU schemes.

9. Location-Specific Considerations

Denmark operates a “Digital Mailbox” for all public correspondence. All companies with a CVR number must activate this service using Mit-ID. Employer obligations are managed through this system, including invoicing and official communications.

Further Information

For more information, or assistance with Denmark Tax inquiries please contact: gi@activpayroll.com

About This Payroll and Tax Overview

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.