Tanzania’s 2019 Budget puts a variety of tax adjustments on the agenda, including tax relief for smaller businesses.

Tanzania’s budget - the Finance Act 2019 - was announced in March 2019 by finance minister Philip Mpango, and many of its proposed measures came into effect on 1 July. The budget places a focus on Tanzania’s National Five Year Development Plan (which commenced in 2016/17): that initiative is intended to build the country’s industrial economy and improve citizen welfare. Accordingly, the 2019 budget includes a number of tax measures designed to provide relief for individual taxpayers, boost business revenue, and reduce administrative burdens.

If you have a business in Tanzania, or are planning to expand into the country, it’s important to get to grips with the tax changes it introduces.

1) Income Tax

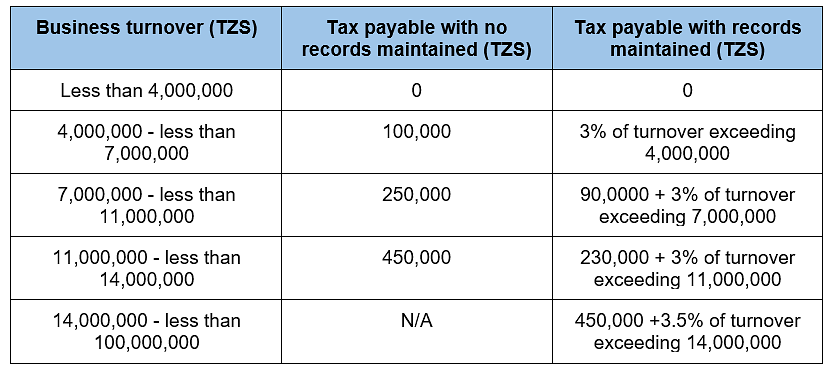

Small Scale Businesses: The budget both increases the minimum threshold for presumptive small business and individual taxpayers, and reduces their associated compliance burden.

- The threshold for individuals and businesses to submit audited financial statements has been raised to TZS100 million (from TZS20 million).

- Taxpayers with earnings or turnovers of between TZS4 million and TZS 100 million will not have to submit financial accounts to the Tanzania Revenue Authority in order to determine tax liability.

The new 2019 tax thresholds are as follows:

Exemption for Government Loans: Service fees and loans provided by banks and other financial institutions to the government are now exempt from withholding tax - with the objective of reducing the cost of government access to external finance.

‘Tampon’ Tax: Recently-established manufacturers of women’s sanitary products will pay a reduced corporate tax rate of only 25% (reduced from 30%) until 30 June 2021 (effectively two years). The reduced rate is dependent on achieving a certain level of government-approved performance but is intended to promote investment, job creation, and product output - with the added benefit of serving women and girls health and welfare across the country.

2) VAT

Benefits for Agricultural Exporters: In a 2017 amendment to Tanzania’s VAT Act, exporters of raw agricultural products were going to be restricted from claiming back input VAT from 20 July 2019. The 2019 budget rescinds that decision: exporters can continue to claim input VAT going forward - a move which is anticipated to reduce costs and make Tanzanian products more competitive in international markets.

Electricity Supply to Zanzibar: Under the 2019 budget, supplies of electricity from Tanzania to Tanzania Zanzibar are now zero rated for VAT purposes.

Sanitary Pads: Hand-in-hand with the reduction of corporate tax on sanitary pads, is a reintroduction of VAT on those products. The reintroduction was prompted after the 2018 VAT exemption on sanitary pads was not followed by a corresponding price drop from traders.

VAT Exemptions & Refunds: The 2019 budget exempts a number of imported productions from VAT:

- Refrigeration boxes for horticultural use (HS Code 8418.69.90)

- Grain drying equipment (HS Code 8419.31.00)

- Aircraft lubricants (HS Codes 2710.19.51, 2710.19.52, 3403.19.00, 3403.99.00), along with airline trade paraphernalia including tickets, brochures, official documents and branded uniforms.

In order to claim refunds on VAT, claimants should ensure their tax invoice or receipt includes:

- Date of issue and supplier details - name, Taxpayer Identification Number (TIN), VAT Registration Number (VRN).

- Description of goods supplied.

- Total payable, including VAT.

- TIN and VRN of customer if value of supply exceeds TZS 100,000.

3) Tax Administration Act

Amnesty Extension: Tax amnesty applicants have been granted an extension to 31 December 2019 (from 30 June 2019) to settle their tax liability. The 2019 budget does not include this amendment but it is set to be confirmed in a government Order which will also clarify procedures for requesting an extension.

Payment Deferment: Newly registered taxpayers with business or investment TINs can defer remittance of tax installments for 6 months. This means they can pay in the respective income year, in 3 (instead of 4) equal installments. Whole tax payable must be paid in cases where deferment would overlap the relevant income year.

Small Scale Vendor Regulations: The 2019 budget grants the Minister of Finance the authority to introduce regulations for tax matters relating to small vendors and service providers.

Tax Ombudsman: An independent, impartial Tax Ombudsman has been introduced to address taxpayer complaints. The Ombudsman will be appointed for renewable tenures of 3 years and be responsible for reviewing complaints, handling mediation, and facilitating taxpayer access to a dispute resolution process. The Ombudsman will not be responsible for reviewing legislation or policy, and will have a duty to handle complaints with complete confidentiality.

4) Food Standards Act

The Finance Act 2019 also has consequences for the Standards Act. In more detail:

- Tanzania Bureau of Standards (TBS) registration is now mandatory for the import, manufacture, distribution, and sale of all pre-packaged food.

- All food importers must be TBS registered.

- Premises used for the slaughter of animals must be TBS registered.

- After consultation with TBS new rules relating to milk, milk substitutes and other milk products will be published.

- New regulations will be forthcoming relating to the sanitary manufacture, storage, transport, and sale of food.

- All cosmetics must conform to TBS standards and certain ingredients will be prohibited.

5) Road Traffic Act

The Finance Act 2019 extends the validity of driving licenses in Tanzania to 5 years (from 3 years). Fees for driving license types have also been increased:

- Standard driving license fees are raised to TZS 70,000 (from 40,000)

- Registration fees for all motor vehicles are raised to TZS 50,000 (from 10,000)

- Motorcycle fees are raised to TZS 30,000 (from 10,000)

- Tricycle fees are raised to TZS 20,000 (from 10,000)

6) Excise Duty Rates

Excise duty rates for a range of products have been introduced or adjusted. Notable examples include:

- Imposition of 10% excise duty on hair (human or artificial) manufactured in Tanzania, and 25% excise duty on imported hair.

- Imposition of 10% duty on imported tubes, pipes, hoses, and other similar plastic fittings.

- Reduction of duty on locally-produced tobacco to TZS 8,000 per kg (from 28,232.40 per kg).

- Reduction of duty on locally-produced wine to TZS 61 per litre (from 200 per litre).

7) Airport and Port Service Charge Act

From 1 July 2019, airport and port agents must file monthly tax returns to the TRA. The deadline for returns is on or before the last working day of the month (following the previous month’s tax charges).

8) Tanzania Food and Drugs Authority

The Tanzania Food and Drugs Authority (TFDA) will now be called the Tanzania Medicines and Medical Devices Authority (TMDA) and be responsible for the regulation of drugs, diagnostics, and medical devices.

Regulation and standards for food and cosmetics safety will now be the responsibility of TBS.

For more information and insight into Tanzania’s tax system, brows activpayroll’s dedicated Tanzania Global Insight Guide.