In 2020, the Brazilian government made changes to its social security contribution rates, and to the amount of benefits paid out to employees.

On 13 January 2020, changes to Brazil’s social security system were announced in the Federal Official Gazette Ordinance No.914. Brazil’s National Institute of Social Security (INSS) is responsible for collecting social security contributions in the country, which cover pensions, educational benefits, workers’ compensation, paternity and maternity, unemployment compensation and more.

INSS Contributions

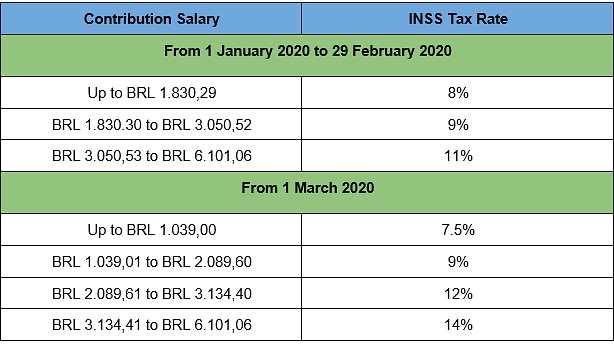

Social security contributions in Brazil are paid by both employees and employers, across rates that vary by salary amount, and that are capped at certain contribution amounts. In 2020, the benefits paid to Brazilian employees by INSS were increased by 4.48%, while the salary cap for contributions was set at BRL 6,101.06.

In more detail the INSS contribution rates and salary caps for 2020 are structured as follows:

In addition to the adjustment of contribution rates, the INSS also announced changes to certain social security benefit amounts:

A minimum payment threshold of BRL 1.039.00 is introduced for,

- Continued payment of retirement, sickness allowance, imprisonment allowance, and death pension benefits

- Retirement of pilots

- Special pensions for thalidomide syndrome victims

The minimum salary contribution of 1,039.00 funds the following INSS benefits:

- Social support for the elderly

- Lifetime monthly income

The Family Allowance quote is set at BRL 48.62 for INSS insured employees with monthly compensation up to BRL 1,425.56.

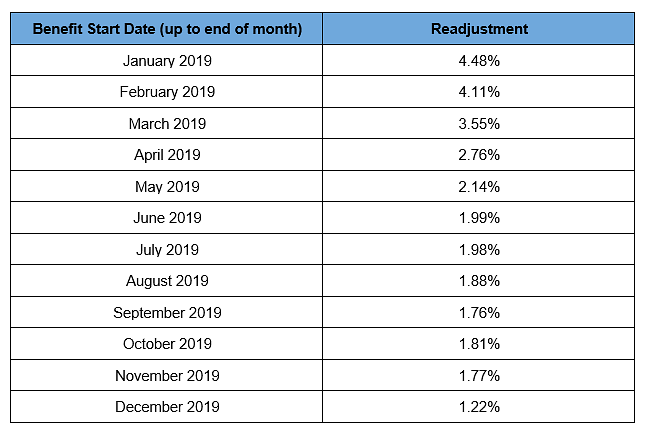

Income from continued INSS benefit payments from January 2019 to December 2019 will be incorporated to reflect the 2020 rate adjustment, subject to the cap of BRL 6,101.06. The breakdown of the readjustment is demonstrated in the following table:

Learn more about Brazil’s tax and social security system in activpayroll’s Global Insight Guide: find information on Brazil’s global economic profile, popular FDI sectors, payroll processes and more.