On 1st April 2020, the UK National Minimum Wage increased by 6.2%.

The increase was announced last year by UK Prime Minister Boris Johnson and has come into effect on 1st April 2020. It is clearly the biggest ever rise in rate of pay since 1999, when the Minimum Wage came into force.

The Advisory, Conciliation and Arbitration Service (ACAS) has rolled out some informative guidance on what this increase means and who will benefit from it.

In this article we focus on the key questions and answers.

What is the minimum wage?

The government sets a minimum amount you must get paid on average for the hours you work. This is called the National Minimum Wage (NMW) or the National Living Wage (NLW) if you’re aged 25 or over.

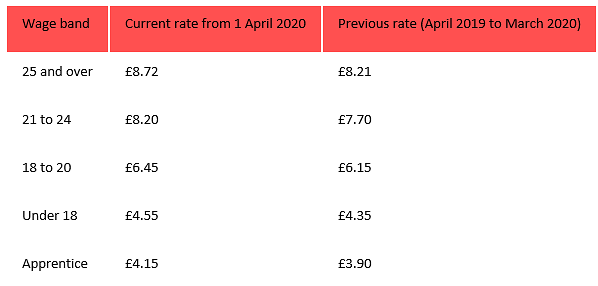

Current rates for the minimum wage

The minimum wage rate varies depending on your age and whether you're an apprentice.

Minimum wage rates are reviewed every year. They usually change in April if there's an increase.

Who gets the minimum wage?

Anyone who is employed as an employee or worker must get the National Minimum Wage or National Living Wage.

This is whether they are:

- full time

- part time

- doing training essential for the job

- working in a small or ‘start-up’ business

It also applies to:

- agency workers

- agricultural workers

- apprentices

- casual labourers, for example someone hired for one day

- casual workers

- employees on probation

- foreign workers

- home workers

- offshore workers

- seafarers

- workers paid by commission

- workers paid by the number of items made (piece work)

- zero-hours workers

The only types of work that are not covered are those who are:

- self-employed (by choice)

- a volunteer (by choice)

- a company director

- in the armed forces

- doing work experience as part of a course

- work shadowing

- under school leaving age

- If you live in your employer's home

When minimum wage increases are paid

There are times when employees or workers will be entitled to a higher minimum wage rate, for example:

- if the government increases the rates (usually in April each year)

- if an employee or worker turns 18, 21 or 25

- if an apprentice turns 19, or finishes the first year of their current apprenticeship

The higher rate starts to apply from the next 'pay reference period' after the increase.

Pay reference period

The ‘pay reference period’ is the period of time the pay covers and this cannot be longer than a month. For example:

- if paid daily, the pay reference period is 1 day

- if paid weekly, the pay reference period is 1 week

- if paid monthly, the pay reference period is 1 month

Check if you are getting minimum wage

Use the National Minimum Wage and National Living Wage calculator on GOV.UK to check if:

- you’re getting paid the National Minimum Wage or National Living Wage

- you’ve been paid correctly in previous years

On average, you must get the minimum wage for each ‘pay reference period’ (the period of time your pay covers).

You work out your average hourly rate using:

- your total (‘gross’) pay each time you’re paid

- how many hours you worked for that pay

Commission

Commission counts towards minimum wage.

Your total pay including commission must give you the minimum wage each time you're paid.

Your employer must ‘top up’ your pay if you have not made enough commission to earn the minimum wage.

What can be deducted from the minimum wage?

Your employer is allowed to make some deductions that could leave you with less than the National Minimum Wage or National Living Wage in your take-home pay. This includes:

- tax and National Insurance contributions

- paying back an advance or overpayment

- pension contributions

- trade union fees

- a charge for accommodation provided by your employer (see accommodation rate information on GOV.UK)

What cannot be deducted from the minimum wage?

Some pay deductions and work-related expenses cannot reduce your pay below the minimum wage.

These include:

- tools

- uniforms

- travel costs (except getting to and from work)

- training courses

What to do if you're not getting minimum wage?

If you're not getting paid the correct National Minimum Wage or National Living Wage rate you can try resolving the issue with your employer.

If you cannot resolve with your employer, you could either:

- report to HMRC to investigate

- make a claim to an employment tribunal

Find out more about the UK payroll and tax system by browsing activpayroll’s Global Insight Guide to the UK.