South Africa has introduced tax relief measures to support employers and employees during the coronavirus crisis.

To help South African employers manage the fallout from the coronavirus crisis, President Ramaphosa has directed the South African government to implement a range of support measures, including tax relief.

In order to protect their businesses, employers and employees should ensure they are familiar with the details of the support available to them. With that in mind, we’ve put together a Q&A dealing primarily with South Africa’s coronavirus tax relief measures...

Q: What kind of coronavirus tax relief is available to South African employers?

A: The South African Revenue Service (SARS) has introduced several tax relief measures to help businesses maintain financial stability during the crisis:

- A 35% PAYE liability deferral to the SARS available for April, May, June, and July. Employers won’t face any penalty or interest on the deferred amount but will need to pay back their liability in six equal amounts from 1 August 2020 to 5 February 2021. Missed repayments will result in penalty charges.

- A holiday from Skills Development Levy (SDL) payment obligations from 1 May to 31 August 2020. Practically, this means that employers that are registered for SDL will not have to declare or pay the levy to SARS.

- An increase to the number of employees who can claim Employment Tax Incentive (ETI), an increase in the amount of ETI that can be claimed (up to R750), and a monthly refund of any excess ETI paid. ETI relief is available for 4 months, from April to July 2020.

In addition to government support during the crisis, employers may also apply to Covid-19 relief organisations that offer specific financial aid packages to help pay employee wages.

Q: Which employers are eligible for the PAYE tax relief measures?

A: Should they choose to apply for Covid-19 PAYE tax relief, employers must satisfy a range of qualification criteria. In more detail, employers must:

- Be trading as an individual, partnership, trust, or company/close corporation/shareblock/co-operative.

- Have incomes no greater than R100 million during the assessment year running from 1 April 2020 to 31 March 2021. Turnover Tax conditions apply.

- Be fully tax compliant, meaning full registration for PAYE and no outstanding returns or debt.

Employers can verify tax compliance status by requesting their latest Statement of Account, checking their MCP page, or calling the SARS Contact Centre.

Q: How can employers apply for their PAYE tax relief?

A: Eligible employers can make their Covid-19 PAYE deferral claim as part of their monthly EMP201 submission online. Employers should complete the EMP201 form as normal, setting out their full PAYE liability (which will be calculated automatically). In order to work out the amount payable with PAYE deferral, employers should take the following steps:

- Submit the EMP201 form to SARS in order to receive a Statement of Account which incorporates the tax relief. The Statement of Account will also include the total amount payable.

Or alternatively,

- Calculate total payable tax yourself, which under the PAYE deferral is 65% of normal liability, before adding SDL payable and Unemployment Insurance Fund (UIF) payable.

Late payment of PAYE liability will result in forfeit of the relief deferral. Employers should check their statement of account after EMP201 submission to ensure that the deferral has been applied.

Q: Can employers claim PAYE relief if they also claim Employment Tax Incentive?

A: All employers may claim Covid-19 PAYE relief in addition to ETI. If an employer claims ETI they must also complete the following process during their EMP201 submission:

- Capture full PAYE liability

- Calculate ETI and calculate 65% PAYE liability

- Limit ETI Utilised amount to the lower of ETI calculated or 65% PAYE liability

- Calculate total payable, less ETI Utilised, plus SDL and UIF payable.

As above, late payment will result in penalties and employers are advised to confirm the application of PAYE relief on their statement of account.

Q: What is the PAYE deferral repayment schedule?

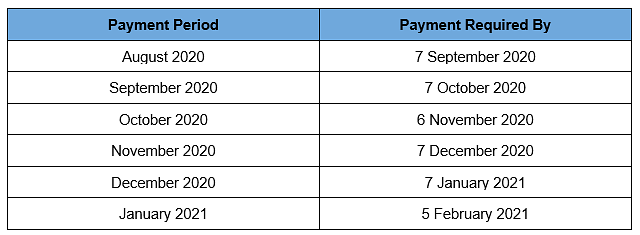

A: SARS will work out how much each employer that makes use of PAYE relief has to pay back after 7 August 2020. As noted above, that amount will be divided across six equal payments and included in the monthly Statement of Account which employers can request from 15 August.

The payment schedule will be set out as follows:

Q: What happens if a PAYE relief repayment deadline is missed?

A: Any missed payments on the 35% PAYE deferral repayment schedule will result in a forfeit of the employer’s Covid-19 tax relief. If a payment is late, SARS will impose a penalty on the full PAYE amount for that month. Employers can appeal for a deferral or even for a waiver of their penalty by contacting SARS.

If the 35% PAYE deferral is not shown on an employer’s account after they have submitted their EMP201 form, it is likely that the qualifying criteria for the tax relief have not been met or that the tax payment was not made on time. Employers should check their EMP201 returns carefully before submission to ensure they are completed correctly.

In some circumstances, employers who do not meet the PAYE deferral qualifying criteria may still receive the relief. Contact SARS online to learn more.

Q: Which employers are eligible for the SDL payment holiday?

A: All SDL-registered employers are automatically eligible for the SDL payment holiday measure, which will be automatically implemented on the EMP201 form for the May to August 2020 tax periods. The SDL payment for April remains due as normal.

Q: Which employers are eligible for the ETI relief?

A: Like the SDL payment holiday measure, ETI tax relief is available to all ETI-qualifying employers as long as they are fully tax compliant (see above). Employers that are unsure whether they qualify for ETI should consult SARS’ online ETI resources.

Q: How does the Covid-19 ETI relief work for employers?

A: The ETI relief allows employers to claim an additional R750 for each ETI-qualifying employee on their payroll. That includes:

- Employees who are currently eligible for the ETI benefit

- Employees between 18 and 29 years of age who no longer qualify for ETI because they have exhausted the 24 month qualifying cycle.

- Employees aged between 30 and 65 who meet the ETI qualifying criteria (including salary bands).

Q: How do employers make their ETI relief claim and receive their refund?

A: Covid-19 ETI relief should be claimed on the monthly EMP201 form. Employers must calculate their additional ETI for all employers and include it in their submission to SARS (see above).

To work out their ETI refund, employers will first need to work out their PAYE liability (see above). If PAYE liability is less than ETI calculated, that excess ETI will be refunded. The ETI refund will be paid within 10 days of EMP201 processing, assuming the employer is fully tax -compliant, not under audit, and has given SARS accurate banking details.

Q: Does additional ETI need to be included in the IRP5/IT3(a) certificate?

A: Employers must include all additional ETI on their IRP5 certificates. Some employers are not eligible for ETI because of the age restriction or because they have used up their 24 month allowance: in these cases, employers may use the additional qualifying cycle option.

Q: Does UIF TERS count as remuneration for ETI calculations?

A: Under the terms of the Income Tax Act, payments from the Unemployment Insurance Fund’s Temporary Employer/Employee Relief Scheme (UIF TERS) are not counted as remuneration for the purposes of ETI calculation. UIF TERS payments are made directly to employers, who then pay their employees.

For example, if an employee who normally earns R5000 can only be paid R3000 as a result of the coronavirus crisis, UIF TERS would pay the employer R2000 to make up the wage. For ETI calculation purposes however, the employee’s remuneration is R3000.

Q: Should employers count payments from disaster relief organisations as remuneration?

A: Several organisations have implemented Covid-19 disaster relief schemes that offer financial support to employers. If an employer successfully applies to one of these schemes, and the financial aid provided by the organisation is used specifically for the payment of wages/salaries, then that payment counts as remuneration - and should be treated as such for tax purposes.

Employers should keep detailed records of any financial support payments that are used to pay employees affected by the coronavirus crisis in order to demonstrate that the funds were not used for other purposes.

Q: How should employers treat payments from disaster relief organisations for the purposes of PAYE and ETI?

A: Payments from Covid-19 disaster relief organisations are exempt from PAYE, but employees should note that those payments will be subject to normal tax assessment rules when they make their income tax returns (ITR12). Employees should declare their payment as a Covid-19 Disaster Relief Fund payment/allowance on their IRP5/IT3(a) certificate (using source code 3724).

Employees should also include payments from Covid-19 disaster relief organisations when calculating ETI, since the payments are classified as remuneration.

Q: What are the tax implications of employer-employee agreements to reduce salaries during the coronavirus crisis?

A: When an employee agrees to unconditionally foreit a portion of their salary for a period of time, then only the reduced salary will be subject to tax regulation. The amount of forfeited salary does not accrue and is not subject to tax. Any UIF and retirement benefits due to the employee must be calculated using the reduced salary amount.

It is important to note that, for these rules to apply, employees must forfeit their salary rather than simply postpone the right to receive it to a later date.

For more information on South Africa’'s labour laws, tax, and payroll landscape, browse activpayroll’s South Africa Global Insight Guide: find background on South Africa's global economic profile, major industrial sectors and common business practices.

For more information on support for employers and employees during the coronavirus crisis contact activpayroll today.