South Africa’s Finance Minister, Tito Mboweni, delivered his 2021 Budget on 24 February. The budget emphasised the need to address the economic damage caused by the global pandemic, which included both a dramatic shortfall in government revenue and unprecedented damage to South African businesses.

With that in mind, the 2021 budget includes a range of measures that will affect South African businesses and individual taxpayers. The key highlights are as follows:

Corporate Income Tax Reduction

Corporate income tax will be reduced to 27% (from 28%) with effect from the 2022-23 assessment year. The reduction will be accompanied by an effort to broaden the corporate tax base with measures to limit assessed losses and interest deductions.

Personal Income Tax Rates

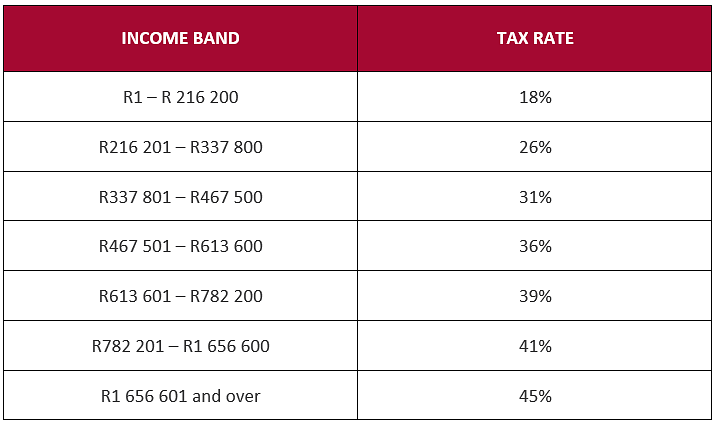

South Africa’s personal income tax brackets will be increased by 5%. The increase is judged to be around 2% higher than the 2020 rate of inflation and is projected to raise around R2.2 billion. Individual income tax rates in South Africa for 1 March 2021 to 28 February 2022 are set at:

Social Grants

The 2021 Budget increases a number of social grant allowances available to individuals:

- Old age pension increased to R1,890 from R1890

- War veterans pension increased to R1,910 from R1,880

- Disability grants increased to R1,890 from R1,860

- Child care increase to R460 from R445

- Foster care increased to R1,050 from R1,040

Excise Duties and Fuel Levy

The excise duties (so-called ‘sin taxes’) on alcohol and tobacco products will be increased by 8% in YA 2021-22.

The fuel levy will be increased to 27c per litre: 15c for the general levy, 11c to the Road Accident Fund, and 1c for the carbon levy.

Employment Programmes

After R83.2 billion in funding for public employment programmes in 2020, R11 billion will be allocated to the Presidential Youth Employment Initiative in 2021. The Finance Minister pointed out that over 430,000 jobs (including temporary and permanent roles) had been created as part of public employment initiatives by the end of January 2021, with 180,000 jobs still in the recruitment process.

Over R66 billion has also been allocated to help 89,000 artisans undergo retraining schemes and fill 320,000 work-based learning places.

Unemployment Insurance Fund

South Africa’s Unemployment Insurance Fund paid out around R102 billion in 2020 as a result of its Temporary Employer/Employee Relief Scheme (TERS), which was put in place to manage the impact of the pandemic on workers.

TERS is scheduled to come to an end in 2021 but the budget estimates that around R93 billion in unemployment insurance will be paid out up to 2024 - meaning that the UIF will run with an average deficit of R19.7 billion over the next 3 years. With that in mind, the UIF contribution ceiling has been set at R17,711.58 per month with effect from 1 March 2021.

Find more information on tax and social security in South Africa in activpayroll’s South Africa Global Insight Guide. Learn more about Coivid-19 support for businesses on our latest news page.