On 26 March 2020, the Singapore Supplementary Budget (also known as the Singapore Resilience Budget) was delivered. The budget includes revised Government revenue and expenditure plans, complements the Unity Budget and the measures taken to manage the economic and social impact of COVID-19.

Some of the key measures to come from the Supplementary Budget are highlighted below:

Wage and Job Support Measures

Enhancement to Jobs Support Scheme (JSS)

The Jobs Support Scheme (JSS), newly launched in the 2020 Unity Budget, will be enhanced as follows:

- Cash grants for employers will increase from 8% to 25% on gross monthly wages of each local worker (this excludes business owners) in employment. The monthly wage cap will be raised from S$3,600 to S$4,600.

- JSS will be extended from three months to nine months, and it will be payable in three tranches by the end of October 2020.

- Higher support for severely affected sectors (including aviation and food service sectors), of up to 75%.

Cash Flow, Cost and Credit Support Measures

Deferment of Corporate Income Tax (“CIT”) Payments

There will be an automatic three-month deferment of all companies’ CIT payments (including installments) due in April, May and June 2020. Consequently, the payments will be collected in July, August and September 2020 respectively.

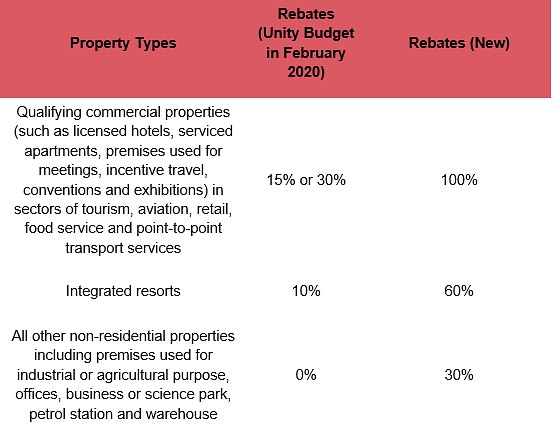

Enhancement to 2020 Property Tax Rebate for Non-Residential Properties

Rental Waivers for Tenants in Government-owned / Managed Non-Residential Facilities

- Increased rental waiver from one month to three months for stallholders of hawker centres and markets, with a minimum waiver of S$200 per month.

- Increased rental waiver from 0.5 months to two months for eligible commercial tenants / lessees, including those providing commercial accommodation, retail, F&B, recreation, entertainment, healthcare, and other services.

- 0.5 months of rental waiver for all other eligible non-residential tenants of Government agencies, including those in premises used for industrial or agricultural purpose, or as an office, a business or science park, or a petrol station.

Withdrawal of Government Fees and Charges

All government fees and charges for one year, from 1 April 2020 to 31 March 2021 will be frozen.

Resilience and Recovery Measures

Enhancement to Productivity Solutions Grant (“PSG”) and Enterprise Development Grant (“EDG”)

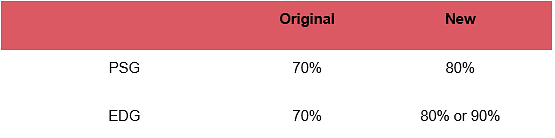

The maximum support levels for PSG and EDG, originally announced at 2018 Budget, will be raised as follows for the period from 1 April 2020 to 31 December 2020:

The scope of PSG will be expanded to include systems and tools to help SMEs implement safe distancing and business continuity measures.

Extension of Enhanced Course Fee Subsidy to New Sectors and Absentee Payroll for Eligible Courses

- Enhanced course fee subsidies of 90% and absentee payroll rates of 90% (capped at S$10 per trainee-hour) for three months are granted for employers in sectors directly affected by the COVID-19, particularly air transport, tourism, retail and food services.

- For enhanced course fee subsidy, the existing sectors are extended to include land transport and arts & culture.

- For absentee payroll, the existing sectors are extended to include land transport and arts & culture starting from 1 April 2020 and further extended to cover all sectors starting from 1 May 2020.

- These training support measures cover eligible courses commencing before 1 January 2021.

Enhancement of Financing Schemes for SMEs

Several financing schemes such as Enterprise Financing Scheme – SME Working Capital Loan, Enterprise Financing Scheme – Trade Loan, Loan Insurance Scheme, Temporary Bridging Loan Programme are now enhanced further with extension of coverage, increase in quantum of borrowing, increase in subsidies and/or increase in Government’s risk-share.

Stay up to date with Singapore’s tax and payroll landscape with our Global Insight Guide to Singapore: find information and insight into Singapore’s global economic profile, business practices, and major industries.