Singapore’s coronavirus Jobs Support Scheme (JSS) has been extended into 2021, find out how to apply to JSS payments below.

The Jobs Support Scheme (JSS) was implemented by the Inland Revenue Authority of Singapore (IRAS) to help employers in Singapore cope with the effects of government-imposed lockdown measures during the Covid-19 pandemic. Introduced on 27 May 2020, the JSS was updated in August 2020 to broaden the financial assistance that it provides to businesses, and help them to retain employees during the crisis.

In order to get the most out of the JSS, businesses in Singapore should be familiar with the benefits it offers and how to apply.

What is the JSS?

A financial support scheme for Singapore’s businesses, the JSS is a way for employers to continue paying their employees during the financial turmoil caused by the coronavirus crisis.

In more detail, the JSS entails:

- Government co-funding of between 25% to 75% of the first $4,600 of employees’ gross monthly wages that were paid in the 10 months leading up to the end of August 2020.

On 17 August 2020, the government announced an extension of the JSS with a lower degree of financial support to cover wages up to March 2021. The JSS extension entails:

- Government co-funding of 10% to 50% of the first $4,600 of employees’ wages between September 2020 and March 2021.

How much will businesses receive from the JSS?

The amount of JSS payment that an employer receives is based on the sector in which they operate. Under the original JSS, employers may receive co-funding of between 25% and 75% of the first $4,600 of their employees’ gross monthly wages, with that amount dropping to between 10% and 50% for the JSS extension.

IRAS has published a list of JSS payment levels organised by specific sectors and sub-sectors, to help employers understand how much they will be receiving.

When will JSS payments be received?

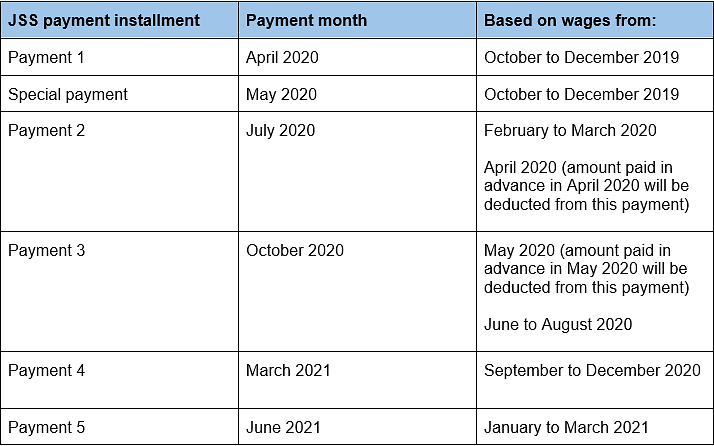

The JSS is paid in 5 installments (plus one special payment), each of which are based on previously paid wages. Those payment installments will take place as follows:

Employers may use the financial support they receive as they see fit in order to keep their business running and retain their employees.

How does the JSS extension work?

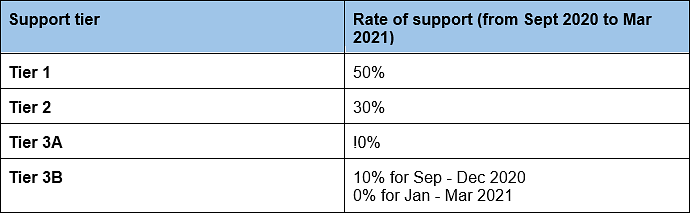

The JSS extension is split into 3 tiers. Like the original JSS, the extension offers varying levels of wage support to businesses with different needs, across different sectors. The extended support scheme involves the following co-funding of wages:

Sectoral exceptions to the tiered support will be applied in the following ways:

- Tier 1 support will be available to the Built Environment sector for two extra months, up to October 2021, while Tier 2 support will be available to the sector from November 2020 to March 2021.

- Tier 1 support will be available to all firms for April and May 2020. Firms that are not allowed to re-open after May 2020 will continue to receive Tier 1 support until they re-open (or until March 2021, if that is earlier).

- Tier 3B is for sectors that have not been badly affected by the coronavirus crisis. This tier covers businesses in the biomedical sciences, precision engineering, electronics, financial services, information and communications technology, media, postal and courier, online retail, and supermarkets and convenience store sectors.

Which businesses are eligible for the JSS?

Almost all businesses in Singapore that have made mandatory Chartered Provident Fund (CPF) contributions are eligible for the JSS and will be enrolled automatically in the scheme (with some exceptions). Employers that are not eligible for the scheme are included on an exclusion list published by IRAS.

To check your business’ eligibility for the JSS, use the online tool hosted on your myTax Portal.

Shareholder-director eligibility: The JSS will also cover the wages of employees who are shareholders and directors of their company - as long as those wages entail mandatory CPF contributions, the employer company was registered on or before 20 April 2020, and the employee’s Assessable Income was $100,000 or less during YA 2019.

Other forms of wages, such as director’s fees, will not be eligible for JSS support - although employees can transition their remuneration to make CPF contributions and become eligible for the JSS going forward.

If firms do not need or want JSS support, it is possible to decline future payments by filling out the Decline JSS form. It also is possible to return unwanted or unused JSS payouts by contacting IRAS.

How is IRAS preventing abuse of the JSS?

Businesses that abuse their JSS support may have their payouts denied by IRAS or even face criminal charges under Section 420 of Singapore’s Penal Code, including a fine and up to 10 years imprisonment.

Examples of JSS abuse include:

- Making CPF contributions for people who are not employees. Individuals that provide employers with personal details (such as NRIC or SingPass details) in order to facilitate this kind of JSS abuse may be considered party to fraud.

- Continuing to make CPF contributions for retrenched employees or employees who are on no-pay leave from their business. It is, however, possible to continue to make CPF contributions for no-pay leave employees if employers have applied for a separate submission number with the CPF board.

- Maintaining the same level of CPF contributions for employees who have suffered cuts to their wages. While a wage cut should lead to a corresponding cut in CPF contributions (and lower JSS payouts), employers can continue to make voluntary CPF contributions with a separate CPF submission number.

- Increasing CPF contributions for employees without also increasing their wages.

- Increasing CPF contributions while deducting the excess from employees’ wages.

- Splitting employee wages across more than one related business entity in order to avoid the JSS’ $4,600 salary limit.

To report suspected abuse of the JSS, businesses or individuals can email IRAS at jssreport@iras.gov.sg.

Find more information on coronavirus support for businesses, employers, and employees, in Singapore and around the world, on the activpayroll Latest News page.

For more information and insight into Singapore’s payroll, tax, and leave regulations, browse our Singapore Global Insight Guide.