As of January 1st 2016, changes were made to Social Security Insurance in Germany. Principally, the social insurance contributions divided 50-50 between employer and employee.

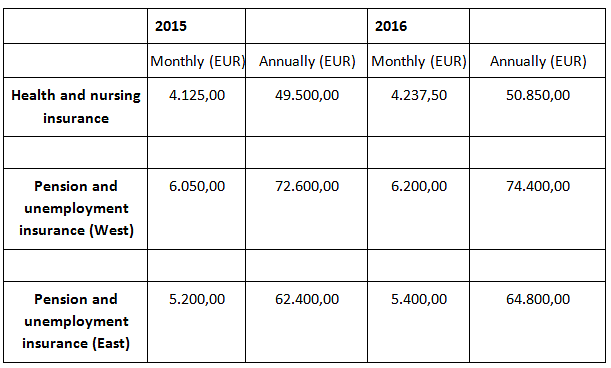

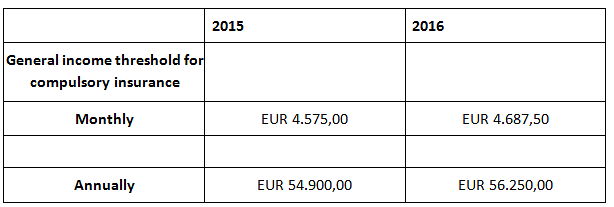

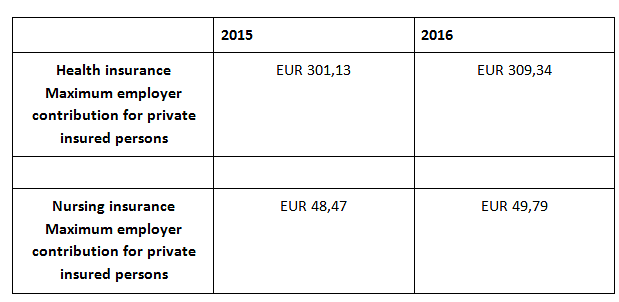

The alterations to the Social Insurance calculations are as follows:

Contribution Rates

The standard health insurance rate of 15,7% is split as follows: the employer portion is fixed at 7,3%. The employee portion is 7,3 % plus 1,1% = 8,4%. The additional contribution rate can vary depending on the health insurance company.

Assessment Ceiling

The insolvency payment contribution is a maximum 0,12% of the assessment ceiling for pension insurance.

Income Threshold For Compulsory Insurance For Employees

For the optional insurance aspect of the health insurance and with the right to change to private health insurance, the income threshold for compulsory insurance for the employee only has to be exceeded for one year.

Health Insurance Employer Contribution

Additional Health Insurance Payments

Some health insurance companies have introduced an additional payment, which is only relevant for the insured person and is settled directly with the employee.

The health insurance company must inform the employee of the special rights to cancel, at least 1 month before the additional payment is due.

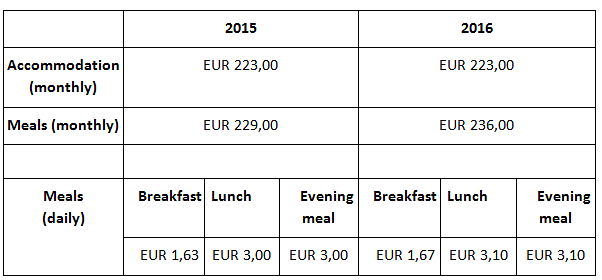

Remunerations

The amounts of remuneration in kind will be determined nationwide. We will inform you of any ongoing alterations.

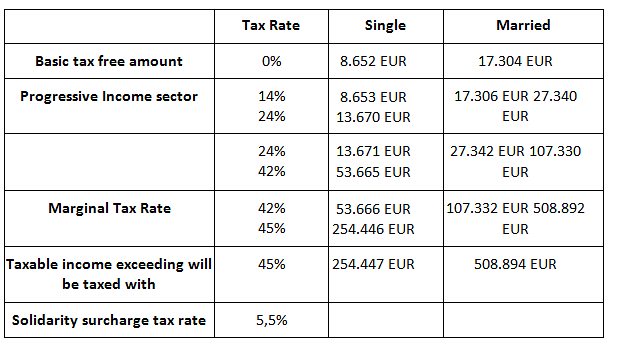

2016 German Income Tax Rates

A solidarity surcharge tax rate is levied on the actual income tax amount.

Updates Regarding Tax Allowances

These include:

Basic Tax-Free Allowance

- Increase of EUR 118 backdated to 1st January 2015 from EUR 8.354 to EUR 8.472

- Further increase of EUR 180 as from 1st January 2016 to EUR 8.652

Child Tax-Free Allowance

- Increase of EUR 144 backdated to 1st January 2015 from EUR 7.008 to EUR 7.152

- Further increase of EUR 96 as from 1st January 2016 to EUR 7.248

Child Allowance

- Increase of EUR 4 backdated to 1st January 2015 from EUR 184 to EUR 188 monthly (for first and second child)

- Increase of EUR 4 backdated to 1st January 2015 from EUR 190 to EUR 194 monthly (for third child)

- Increase of EUR 4 backdated to 1st January 2015 from EUR 215 to EUR 219 monthly (for fourth and further children)

- Further increase of EUR 2 monthly per child as from 1st January 2016

Child Supplement

The child supplement will benefit parents who can cover their own needs in principle by earned income, but do not have sufficient financial resources to meet the needs of their children.

- Increase of EUR 20 monthly as from 1st July 2016 from EUR 140 to EUR 160 monthly