Australian businesses that have been affected by the coronavirus crisis may be eligible for the extended JobKeeper Payment scheme.

As Australia continues to manage the fallout from the global coronavirus pandemic, the government has introduced special measures to help businesses cope with the financial burden of lockdown restrictions. The measures include the JobKeeper Payment scheme, a wage subsidy for eligible employers to help keep employees in work. JobKeeper Payment subsidies originally offered $1,500 per fortnight for eligible workers - around 70% of Australia's national median wage.

In August 2020, the Australian government agreed to extend the JobKeeper Payment, making the scheme available to eligible businesses until 28 March 2021 and introducing important changes. If you are an employer seeking to apply for the JobKeeper Payment, it’s important to understand whether your business is eligible for the scheme, and what rates of payment you will receive.

JobKeeper Payment rates

The JobKeeper extension means that its payment rates will change.

The current rate of $1500 per fortnight, will continue until 27 September 2020. However, from 28 September 2020, the JobKeeper payment will enter its extension, which will consist of two periods:

- The first extension period will run from 28 September 2020 to 3 January 2021

- The second extension period will run from 4 January 2021 to 28 March 2021

For each extension period, Australian businesses will have to meet a new eligibility test, based on fall in actual turnover, while the rate of the JobKeeper payment will vary depending on the hours that eligible employees work at their business. The payment will also cover eligible ‘business participants’ who may not be classified as employees of the business but who have engaged in it for a certain period of time.

In more detail, the JobKeeper Payment rates will be split into two tiers.

Tier one payments:

Applicable to:

- Eligible employees who have worked for 80 hours or more across 4 weeks before either 1 March 2020 or 1 July 2020,

and

- Eligible business participants that were actively engaged in their business for at least 80- hours or more in February 2020 - and can prove that with a declaration from the business.

Tier two payments

Applicable to:

- Any other eligible employees or business participants

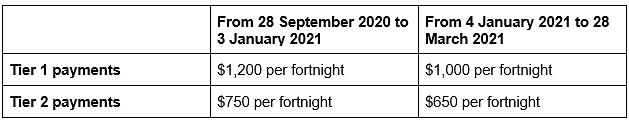

Tier one and tier two payment rates will vary depending on the extension period:

Both tier one and tier two payments are subject to normal tax liabilities.

Determining JobKeeper eligibility

Eligibility for the JobKeeper Payment scheme is determined by a set of qualification criteria applicable to employers, employees, and sole-traders. Each group of applicants can check their eligibility, and other relevant information on the payment scheme, on the ATO’s website.

Information and assistance

The JobKeeper Payment scheme is not available to everyone but if you feel your application has been incorrectly rejected, you can access guidance on workplace entitlements and other statutory obligations via the ATO. Visit the dedicated JobKeeper disputes page for more information.

Similarly, if you suspect that a business or individual is incorrectly or inappropriately receiving JobKeeper payment, you tell the ATO about it via their tip-off page.

For more information on Australia’s labour laws, tax, and payroll landscape, browse activpayroll’s Australia Global Insight Guide: find background on Australia's global economic profile, major industrial sectors and common business practices.

Find more information and guidance on coronavirus support measures for businesses, employers, and employees, on the activpayroll latest news page.