Sri Lanka

Sri Lanka has been earmarked by many investors (local & foreign) because of its fast-growing economy, geographical location, diversity, quality human resources, peace & stability.

Need more information about payroll, compliance and social security in Sri Lanka?

Talk to a specialist

Our free global insight guide to Sri Lanka offers up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Basic Facts about Sri Lanka

Sri Lanka, an island nation in South Asia, is known for its rich cultural heritage and diverse landscapes. Located in the Indian Ocean, south of India, it covers an area of about 65,610 square kilometers.

Sri Lanka boasts a history that spans over 3,000 years, with evidence of pre-historic human settlements dating back at least 125,000 years. Its strategic location along ancient trade routes played a significant role in its history, as it was a hub for the maritime silk road. The nation's diverse population is a tapestry of ethnicities and religions, with Sinhalese, Tamil, Muslim, and Christian communities.

Its economy traditionally depended on agriculture, particularly tea, rubber, and coconut exports, but in recent years, it has diversified into manufacturing and services, including tourism. Despite its natural beauty and cultural wealth, Sri Lanka has faced challenges, including a devastating civil war that lasted from 1983 to 2009, and more recent economic struggles. The country is also renowned for its rich biodiversity, with numerous wildlife reserves and a commitment to conservation.

As of early 2024, Sri Lanka's economy is undergoing significant challenges, characterised by high inflation, foreign debt burdens, and currency devaluation. These economic difficulties have impacted business operations, with increased costs and uncertainty for investors, although efforts are being made to stabilize the situation and attract foreign investment.

General Information

- Full name: Democratic Socialist Republic of Sri Lanka

- Population: 22.1 million (World Bank 2022)

- Capital City : Sri Jayawardenepura Kotte

- Commercial Capital: Colombo

- Major Languages: Sinhala and Tamil with English being the business language

- Monetary Unit: Sri Lankan Rupee

- Main Exports: Garment manufacturing, tea, gems, coconuts and rubber, ITBPM

- GNI per Capita: US $3,610 (World Bank, 2022)

- Internet Domain: .lk

- International Dialing Code: +94

How Do I Say in Tamil?

- Hello வணக்கம்

- Good Morning குட் மார்னிங்

- Good Evening நல்ல மாலை

- Do you speak English? நீங்கள் ஆங்கிலம் பேச?

- Good Bye குட்பை

- Thank You நன்றி

- See you Later பின்னர் நீங்கள் பார்க்க

The business language in Sri Lanka is English, however Sinhalese and Tamil are commonly used as they are the two main ethnicity in Sri Lanka.

Dates

Dates are usually written in the day, month and year sequence, for example 1 July 2024 or 1/7/24.

Why Invest in Sri Lanka?

Sri Lanka has been earmarked by many investors (local & foreign) because of its fast-growing economy, geographical location, diversity, quality human resources, peace & stability. Since the end of the civil war in mid-2009, the country's economy has been growing rapidly due to measures, surging tourism & other industries and increased investor confidence.

After a sharp decline in growth during 2008-2009, it expanded rapidly by 8% in 2010. The government is also emphasising the importance of carrying out large infrastructure projects, which will not only improve communications in established areas, but also unlock the hidden potential of other locations.

Foreign Direct Investment in Sri Lanka

Foreign Direct Investment (FDI) in Sri Lanka plays a pivotal role in the nation's economic development, particularly in the post-civil war era.

The government, keen to attract international investors, has implemented policies to create a more favorable business environment, including tax incentives, infrastructure development, and easing of regulations. Key sectors attracting FDI include tourism, real estate, telecommunications, and renewable energy.

The strategic geographical location of Sri Lanka, serving as a gateway to Asian markets, along with its deep-water ports, adds to its appeal as an investment destination. However, challenges such as political instability, bureaucratic hurdles, and economic volatility have sometimes hindered the flow of FDI. Despite these obstacles, the country continues to focus on creating a more conducive environment for foreign investors to aid in its economic recovery and long-term growth.

Doing Business in Sri Lanka

Doing business in Sri Lanka offers a unique blend of opportunities and challenges. The country's strategic location at the crossroads of major shipping routes, its growing economy, and its access to key Asian markets make it an attractive destination for international businesses.

The government has been actively working to improve the ease of doing business by streamlining processes, offering tax incentives, and investing in infrastructure development. Key sectors with potential for growth include tourism, information technology, and manufacturing. However, businesses must also navigate certain challenges, such as bureaucratic red tape, fluctuating economic policies, and occasional political instability. Understanding the local culture and business etiquette is crucial for successful operations. Despite these challenges, Sri Lanka's emerging market status, coupled with its skilled workforce and natural resources, presents significant opportunities for foreign businesses looking to expand in the region.

As of 2024, Sri Lanka's economy is projected to grow by 1.7%, following a period of economic contraction of 3.8% in 2023. This forecast by the World Bank indicates a gradual recovery, amidst efforts like sovereign debt restructuring. However, the economic outlook remains uncertain, with challenges in debt restructuring negotiations, particularly with private creditors. The growth rate in South Asia, where Sri Lanka is situated, is estimated to have slowed slightly to 5.7% in 2023 but still remains the fastest among emerging markets and developing economy regions according to the World Bank.

Business Banking in Sri Lanka

For making salary and third-party payments, the client has the option to operate through its own company bank account, giving access to the payroll provider’s staff, or to operate through the payroll company’s bank account by transfer of funds.

The payments to the employee and/or authorities can be done by:

- Cheque

- Online

- Cash

However, cash payments are discouraged in order to ensure audit trails of payments made.

It takes two working days for funds to reach the employee’s bank account when the transfer is between different banks, otherwise the same day.

For international transfer payments, i.e. payments to an employee who holds a bank account out-with the payroll country, the client must comply with all Exchange Control regulations and needs to obtain Exchange Control approval.

An expat can open a NRFC account with a local bank to receive salaries.

Registering a Company and Establishing an Entity in Sri Lanka

In order to process payroll in Sri Lanka a legal entity must be established.

The procedure for registering a company in Sri Lanka is as follows:

- Reserve a unique company name: Searching for a unique company name can be done online via the website of the Department of the Registrar of Companies.

- The company secretary signs a consent: Every company shall have a secretary that is employed before incorporation

- Register at the Department of the Registrar of Companies: A company may draft or adopt the standard set of articles of association in Table A of the Companies Act of Sri Lanka. Professional charges are higher for drafting new articles of association than for adopting the standard articles.

- Public Notice of Incorporation: Public notice must be given within a month of the incorporation of a company this is usually done via posters and/or the Gazette (Newspaper).

- Register with the tax authorities and obtain a Tax Identification Number (TIN)

- Register with the Department of Labour and obtain the EPF number

The companies looking to process payroll in Sri Lanka must be registered for APIT and Stamp Duty with the Department of Inland Revenue before the first month of recovery is payable.

To register for Employees’ Provident Fund (EPF) the company must be registered with the Labour Department of Sri Lanka before the first month is payable. The client will then also be automatically registered for Employee’s Trust Fund (ETF).

Visas and Work Permits in Sri Lanka

All foreign nationals must obtain visa to enter Sri Lanka. If they intend to work they will need both a residence visa and a work permit.

Before obtaining a residence visa you must arrive in Sri Lanka on an entry visa that has been issued by a Sri Lanka Overseas Mission abroad

A Visit Visa is an entry permit and it’s issued by the Sri Lankan government giving a foreign national permission to visit the country. The Visa contains details of the period of time and the condition/s of the stay.

There are two sub-categories which come under Visit Visas:

- Tourist Visit Visa: A Tourist Visa is issued to bona-fide tourists who want to enter Sri Lanka for sightseeing, excursions, relaxation, visit relatives or yoga training for a short period of time.

- Business Purpose Visa: A Business Purpose Visa is issued to foreign nationals visiting Sri Lanka for business purposes for short period of time. This visa may be issued for single or double journeys.

Residence Visas are usually issued for a period of one year and can be renewed annually for a cost.

The application form can be obtained from and submitted to Department of Immigration & Emigration Colombo, however if a foreign national has a potential employer the process can be completed by the employer. It is advised to engage a travel consultant to get the necessary support to identify the correct visa category and process.

Income Tax in Sri Lanka

The tax year runs from 1st April to 31st March in Sri Lanka.

In order for the payroll provider to make any tax and/or social security filings on behalf of the client, there are no special licensing requirements; however, a signed authorisation to handle its affairs is required.

Income Tax

Income tax in Sri Lanka is paid under an Advance Personal Income Tax scheme (APIT). The employer makes deductions of taxes for employment remuneration at source based on tables provided by the revenue authorities.

There is also a stamp duty of Rs 25 per employee applicable when the net salary exceeds Rs 25,000.00.

Residents that earn over LKR 1,200,000 per annum from employment are subject to income tax.

Any non-residents are taxed on the income derived from Sri Lankan sources only.

Individuals are considered resident for tax purposes if they are present in Sri Lanka for more than 183 days in a tax year. A resident guest and a dual citizen are subject to tax only on income derived in Sri Lanka.

There are several categories of taxable income. All income from a trade, employment, rentals, dividends, interest, royalties and any other income is taxable. Payroll will deduct only APIT from employment income and benefits reported for payroll processing. APIT tables are given below. Employees are liable to pay other income related taxes individually and file the annual return.

Monthly tax contributions compliance dates:

- APIT: 15th (or the working day before) of the following month;

- Stamp Duty: 20th (or the working day before) of each Quarter end.

The penalty for late submissions/payments of any tax will be decided by the relevant authority based on the time and the type of violation.

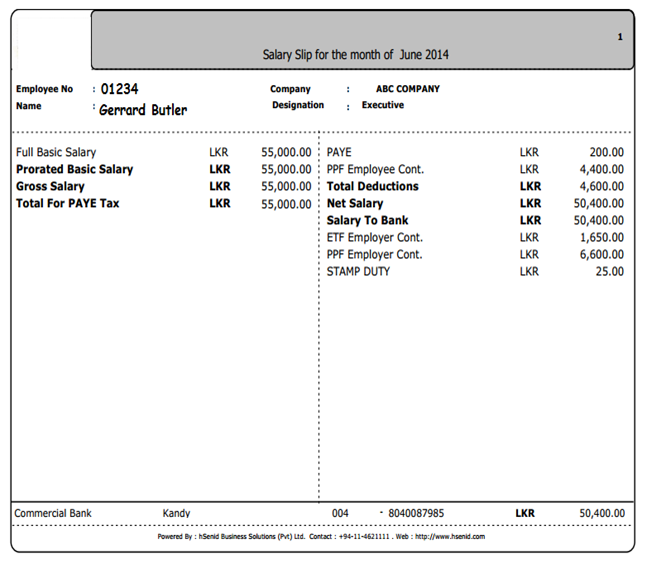

Calculation example:

The below tax calculation is based on a single employee on an average wage.

| Basic Salary | Prorated Basic Salary | Total Gross Salary | Total Taxable | PAYE | PPF Employee Contribution | Total Employee Deductions | NET Pay |

| 55,000.00 LKR | 55,000.00 LKR | 55,000.00 LKR | 55,000.00 LKR | 200.00 LKR | 4,400.00 LKR | 4600.00 LKR | 50,400.00 LKR |

Social Security in Sri Lanka

Being the largest Social Security scheme in Sri Lanka, the Employee Provident Fund, EPF, is handled by the Labour Department of Sri Lanka whilst the management of the funds is handled by EPF department of the Central Bank.

The contribution rates for the EPF are 8% of any total earnings for the employee, while the employer will contribute 12% of the employees’ earnings.

Employers must also contribute 3% of each employee’s total earnings to the Employee Trust Fund (ETF).

Both EPF and ETF payments should be made before the end of the following month.

The penalty for late submissions/payments of any tax and/or social security will be decided by the relevant authority based on the time and the type of violation.

There are no Government Pension Schemes applicable to private sector employees.

Reporting Tax in Sri Lanka

Monthly reporting

APIT

- A remittance form should be submitted.

- Includes information such as the period, cheque number, amount paid and the date.

- The payroll provider can sign and submit this document before the 15th of the following month

EPF / ETF

- This is a bank text file system generated

- It includes details of employee contributions, the period and amount.

- Online submitted by the payroll company

Quarterly reporting

Stamp Duty

- A remittance and return form must be submitted.

- Information such as the number of receipts, period and amount is included.

- The payroll provider can sign and submit this document on the 20th of the month before each Quarter end.

Yearly reporting

APIT Annual Return

- Documents that must be submitted:

- PAY Return 94(1)– Annual APIT Return – to be submitted with T9A

- T 10 – Gross Emoluments and tax deductions

- T6 – Individual detailed earnings and deductions for 12 months

- The information required to complete the form is Gross remuneration and tax deducted

- The individual employee will need to file the return either on line or paper form.

New Employees in Sri Lanka

In Sri Lanka, any new employees must be registered with the Labour department before any payments or contributions can be made.

All new starts should be registered with the authorities immediately after joining the company, although there are no given time restrictions.

Any new starts must fill out a new start registration form, which includes details such as:

- Name

- Address

- National Identity Card Number

- Nationality

- Status (Married/Single)

- Details of family members

The employer is responsible for the Expat new hire statutory registrations, which is dependent on the length of stay in Sri Lanka.

Expats can open a NRFC account with a local bank in order to receive their salaries.

Should salaries be sent outside Sri Lanka, the employer needs to obtain the Exchange Control approval.

Leavers in Sri Lanka

In Sri Lanka, there is a legislative requirement to pay any employee’s leaving the business within 30 days.

There are no notifications to be made when an employee leaves the organisation.

When an employee leaves the company after having worked there for 5+ years, they are entitled to a gratuity payment. This payment is half of one month’s salary for each year of service. This payment is taxable.

Payroll in Sri Lanka

In Sri Lanka, it is within the boundaries of the law to provide online payslips to the employees.

In order to process payroll a legal entity must be established & registered with the Labour Department for EPF/ETF purposes.

Reports

Payroll reports must be kept for 10 years.

Payslip Example

English language example:

Employment Law In Sri Lanka

Holiday Accrual / Calculations

In Sri Lanka, employees will be granted Statutory Holidays and “Poya Holidays” as determined by legislation.

Shop/office workers shall be entitled to paid leave each year (in addition to any public holidays):

- where employment commences on or after the first day of January but before the first day of April, a holiday of 14 days with full remuneration;

- where employment commences on or after the first day of April but before the first day of July, a holiday of 10 days with full remuneration;

- where employment commences on or after the first day of July but before the first day of October, a holiday of 7 days with full remuneration; and

- where employment commences on or after the first day of October a holiday of 4 days with full remuneration

On the second year of employment office/shop workers shall be entitled to take 14 days paid leave in addition to any public holidays.

If any Statutory Holidays fall on a weekly half day, an additional half-day shall be granted on the working day immediately preceding it and if it falls on a weekly holiday, a substitute holiday shall be granted on the working day immediately succeeding such weekly full holiday.

Each employee in office/shop will be entitled to 1 ½ days holiday weekly and industrial employees shall be entitled to 1 day holiday per week.

For industrial employee’s there are no strict statutory holidays, however employers will usually grant 14 days paid leave per year.

It is advisable to seek legal opinion when setting the leave policy to ensure alignment with minimum legal requirements.

Maternity Leave

In Sri Lanka, women working in companies that are covered by the Shop and Office Act are entitled to 84 days of maternity leave, this excludes all weekly holidays, “Poya” days and statutory holidays for the birth of the first and second child. For the birth of the 3rd + child the allowance shall be 42 days, excluding any statutory holidays, weekly holidays and “Poya” days.

All women are entitled to full pay as though they would have worked during the period of leave.

It is not possible to terminate or dismiss a female employee during a period of maternity leave.

On the other hand, in companies covered by the Maternity Benefit Ordinance, the entitlement is 84 days (non-working days included) for the first and second child, while for the third + child; the entitlement is 6 weeks (non-working days included).

Employees will only be paid for the first 6 weeks of leave.

On returning to work, the employee shall be entitled to two nursing intervals until the child is one years old.

All employers must also provide a crèche for children up to 6 years old.

Paternity Leave

There is no paternity leave allowance in Sri Lanka however, organisations may individually opt to give paternity leave at their discretion.

Sickness

In Sri Lanka, sick leave is not provided for through legal provisions, however most employers will allow up to 10 days of paid leave for any illness or will cover this in annual (holiday) leave.

National service

There is no mandatory national service in Sri Lanka.

Working Days and Working Hours in Sri Lanka

In Sri Lanka, the standard working days and hours are structured to accommodate both the needs of businesses and the well-being of employees. The year 2024, which is a leap year, consists of 366 days in total. Within these, there are 104 weekend days, 25 public holidays, and 237 working days. However, if people take replacement holidays for public holidays falling on weekends, the total number of working days becomes 243.

The general work schedule in Sri Lanka varies by sector. For example, state sector office hours are typically from 9 a.m. until 4:45 p.m., whereas private sector work hours are from 9:45 a.m. until 6:45 p.m. This means that state sector employees work for about seven hours and 45 minutes a day, while private sector employees work for nine hours a day.

It's important to note that these hours can vary based on specific industries and agreements between employers and employees. Additionally, transport services like the Sri Lanka Transport Board (SLTB) are prepared to extend their usual operating hours to accommodate these working hours.

Employee Benefits in Sri Lanka

When an employee leaves the company after having worked there for 5+ years, he’s entitled to a gratuity payment. This payment is half of one month’s salary for each year of service. This payment is taxable.

There are client specific benefits offered locally. Both cash and benefits in kind are liable for tax. Payroll reports will capture such benefits.

Expenses

There is a travel allowance of Rs. 50,000 and any expenses up to this limit are exempt from tax. However, any remaining balance will be taxable.

If any reimbursements have to be made through the salary, client should be able to substantiate this.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.