On Tuesday 12th October, Ireland's Finance Minister, Paschal Donohoe and Minister for Public Expenditure, Michael McGrath, announced a €4.7bn budget package to the Irish parliament (Dáil). The budget covers key areas such as changes to personal tax credits, Universal Social Charge (USC) and the Employment Wage Subsidy Scheme (EWSS).

The below changes will take effect from 1st January 2022 (unless otherwise state).

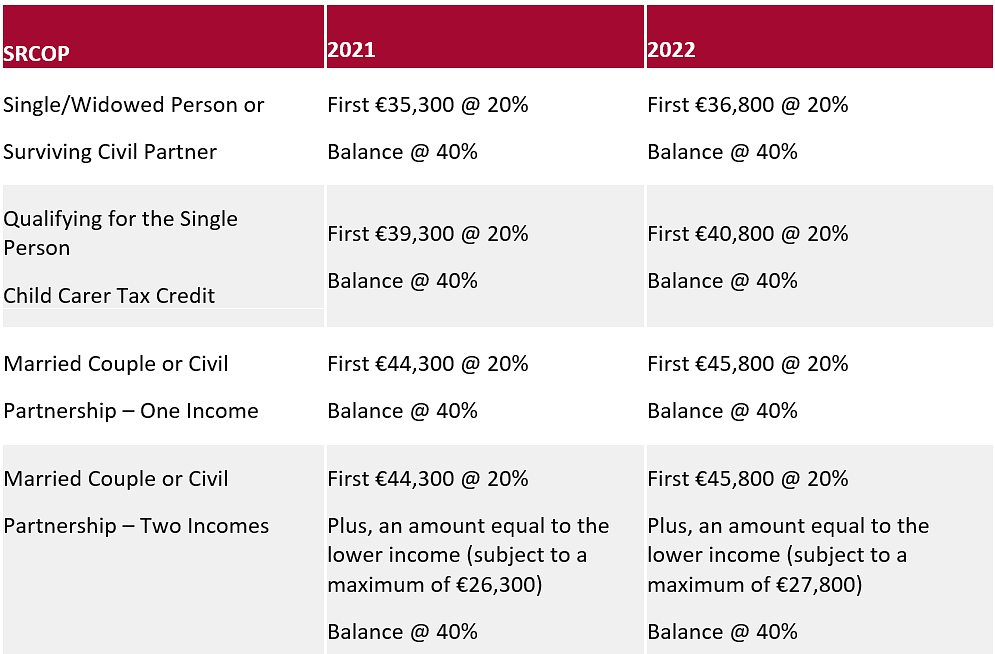

Tax Rates and SRCOPs

No changes have been made to tax rates for 2022, the standard rate of 20% and higher rate of 40% will remain the same.

The Standard Rate Cut-Off Points (SRCOPs) have been increased for 2022:

Applicable under the ‘Emergency Basis’ of tax, the SRCOP will increase from:

€679 to €708 per week

€1,358 to €1,416 per fortnight

€2,942 to €3,067 per month

Personal Tax Credits

From 2022, the following changes will apply:

Single/Widowed Person or Surviving Civil Partner Tax Credit - Increased by €50 from €1,650 to €1,700

Married Couple or Civil Partnership Tax Credit - Increased by €100 from €3,300 to €3,400

Employee (PAYE) Tax Credit - Increased by €50 from €1,650 to €1,700

Earned Income Tax Credit - Increased by €50 from €1,650 to €1,700

Sea-Going Naval Personnel Tax Credit - This tax credit will be extended for 2022

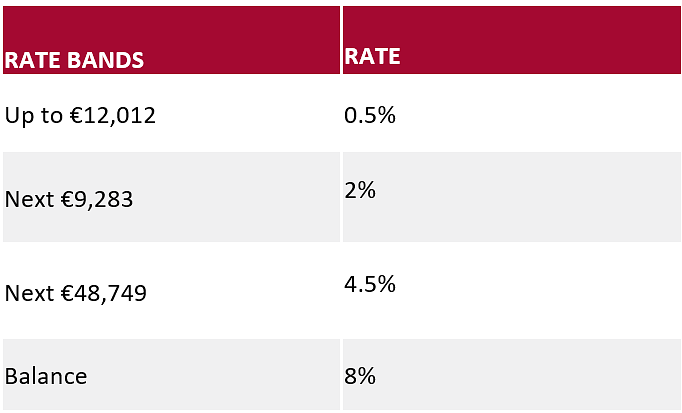

Universal Social Charge (USC)

There has been no change to the USC exemption threshold of €13,000 and there has been no change to the rates of USC. The threshold for the 2% rate will be increased by €608 from €20,687 to €21,295.

From 1st January 2022, USC will apply at the following rates (for employees earning in excess of €13,000):

Income (non-PAYE) in excess of €100,000 will continue to be subject to a 3% USC surcharge.

Individuals who are medical card holders, aged 70 years and over and whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2% as of January 2022.

Under the ‘Emergency Basis’, the rate of 8% USC will continue to apply.

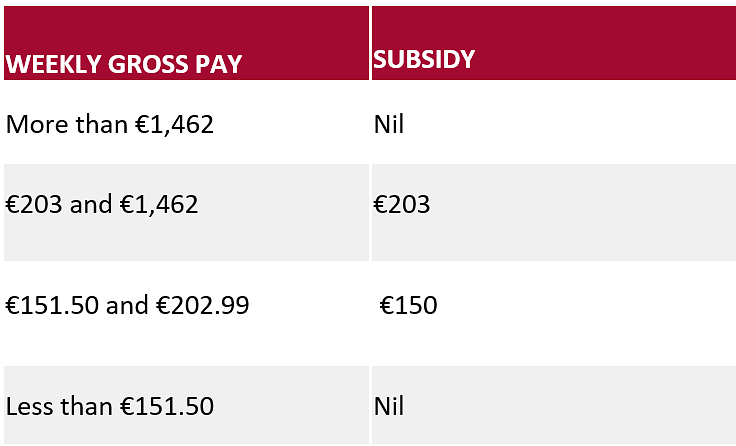

Employment Wage Subsidy Scheme (EWSS)

Despite original plans to wind down the EWSS by the end of this year, it will now be extended until April 2022 in a phased-out format.

Current rates for October and November 2020 will be retained.

Employers availing the scheme on 31st December 2021 will continue to be eligible until 30th April 2022 so long as they meet the eligibility criteria which will continue to be a 30% reduction in turnover/customer orders in 2021 compared to 2019.

The scheme will officially close for new claims on 1st January 2022.

For the months of December, January and February, the original two-tier structure will apply:

For the months of March and April 2022, a flat rate subsidy of €100 will replace €203 and €150. The rebate of Employers’ PRSI will no longer apply for these two months.

Remote Working

Employers are permitted to make tax free payments of up to €3.20 per working day to remote workers to cover additional utility costs incurred due to employees working from home. If an employer does not pay remote employees this fee, employees are instead able to claim tax relief on 30% of the cost of vouched expenses for light, heat and broadband in respect of the days spent working at home.

VAT

Until the end of August 2022, the reduced rate of 9% VAT will continue to apply to the hospitality sector.

Employment

National Minimum Wage (NMW) - Will increase by 30 cent from €10.20 to €10.50 per hour in respect of hours worked on or after 1st January 2022.

Parent’s Leave - Will increase by two weeks from five weeks to seven weeks, accompanied by Parent’s Benefit payable by the DSP from July 2022.

Interested in doing business in Ireland? Find out everything you need to know about payroll, tax, social security, employee benefits, work permits, employment law and more in activpayroll’s Guide to Doing Business in Ireland. This is available as a free PDF to download.