As Australia prepares for the first end of financial year event with STP, whereby Payment Summaries may not be issued, here is a snap shot of what employers and employees need to know.

The introduction of STP in July 2018 aimed to streamline employer reporting requirements with real-time reporting being sent each pay day to the ATO. As a result, there is no longer the need to issue employees with a finalised statement of what they have received in income and paid in withholdings throughout the year. This information has instead been available to all employees in their ‘myGov’ portal throughout the year.

Most of our customers will have already noticed a message appearing on the bottom of the payslips that states: “Income for the 2019 financial year is being reported through STP – No Payment Summaries will be issued. Finalised year-end figures will be available in your ‘myGov’ portal by 12th July 2019.”

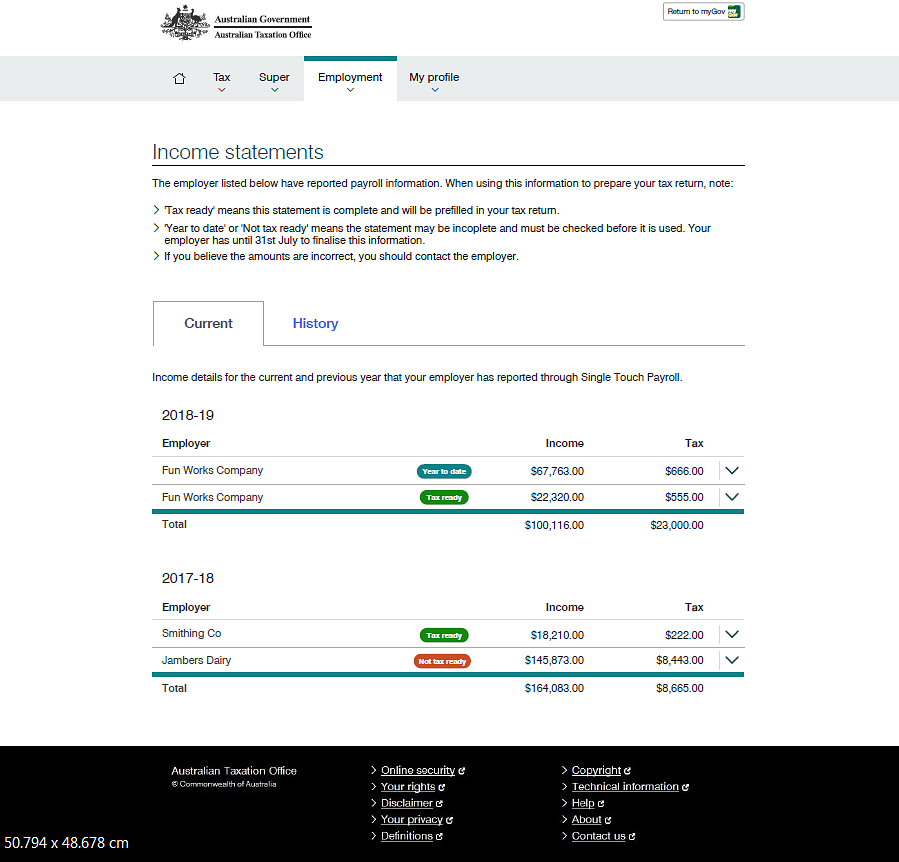

For employers: once the final pay has been paid for the year, the STP reporting will include a declaration that it is the final reporting for the year and all income has been declared through STP. When this happens, employees will see the following screen in their ‘myGov’ portal:

RFBT figures still need to be provided for inclusion in the final STP. These are due to activpayroll by Monday 1st July 2019.

For employees: tax returns can be filed once the green “Tax Ready” icon appears in your portal. If you require a statement of earnings, this is no longer the responsibility of an employer to issue. Instead, you can request this through the ATO.

For more information please contact our Payroll Operations Manager – Australia Melanie Gaensler on +61 8 6280 0176 or email melanie.gaensler@activpayroll.com.