Estonia

Estonia demonstrates its digital savviness through practical offerings, such as e-Residency, a revolutionary initiative that allows international entrepreneurs to start and manage a business from any location worldwide.

Need more information about payroll, compliance and social security in Estonia?

Talk to a specialist

Our free global insight guide to Estonia offers up-to-date information on international payroll, income tax, social security, employment law, employee benefits, visas, work permits and key updates on legislative changes and more in 2024.

Basic Facts about Estonia

General Information

- Official Name: The Republic of Estonia

- Population: 1.34 million (World Bank 2022)

- Capital: Tallinn

- Official Language: Estonian (Russian, English and Finnish are also widely spoken)

- Major Religion: Christianity

- Monetary Unit: Euro

- Main Exports: Electrical and machinery equipment, wood products, mineral fuels (including oil) and vehicles

- GNI per Capita: US $28,333 (World Bank, 2022)

- Internet Domain: .ee

- International Dialling Code: +372

How Do I Say in Estonian?

- Hello: Tere

- Good morning: Tere hommikust

- Good evening: Tere õhtust

- Do you speak English?: Kas sa räägid inglise keelt?

- Good bye: Head aega

- Thank you: Aitäh

- See you later: Näeme hiljem

Dates

Dates are usually written in the day, month and year sequence. For example, 1 July 2024 or 01/07/2024.

Numbers are written with a period to denote thousands and a comma to denote fractions. For example, €3.000,50 (three thousand euros and fifty cents).

Doing Business in Estonia

Estonia stands proudly as a paragon of digital advancement and economic ingenuity, setting the gold standard for modern business practices. Its rise as a hub of global commerce is no accident; it’s a triumph of strategic governance and an open-minded adoption of technology. For businesses looking to operate within Estonia's borders, the process is remarkably smooth and facilitated by a government that welcomes foreign investment and innovation. The nation offers a spectrum of opportunities to businesses keen on leveraging its digital ecosystem, which is among the most advanced in the world.

This Northern European republic is not merely content with proclamation but demonstrates its digital savviness through practical offerings, such as e-Residency, a revolutionary initiative that allows international entrepreneurs to start and manage a business from any location worldwide, tethered to the Estonia's digital services.

The country’s straightforward tax system, which includes a unique flat income tax, exemplifies its commitment to fiscal transparency and simplicity. For a business looking for an environment where bureaucracy is minimised and efficiency is maximized, Estonia is an attractive candidate.

When outlining the commercial landscape, a key highlight is Estonia’s pioneering work in public e-services and cyber security, setting a confident baseline for private sector digital integrations. The country’s infrastructure is a beacon for tech-forward companies and boasts a population that is highly educated, tech-literate, and proficient in English, easing communication for international entrants.

Regulatory frameworks in Estonia are structured to foster entrepreneurship and encourage trade. This can be seen in the ease of business registration, which is often completed in a matter of hours, and the transparent property registration systems. Estonia’s business environment is further enhanced by competitive costs, particularly in terms of logistics and utilities, and a welcoming approach to blockchain technologies and cryptocurrencies, paving the way for innovative business models and fiscal operations.

Why Invest in Estonia?

Within the panorama of global investment, the North-European nation of Estonia emerges as an attractive prospect, presenting a unique blend of factors that contribute to a dynamic and rewarding investment climate. Estonia stands out due to its strategic inclination towards open market policies, a robust business environment, and a resilient economy that has established itself as a beacon of innovation and stability.

Officially affiliated with notable global institutions such as the European Union, World Trade Organization, and Organisation for Economic Co-operation and Development, Estonia has managed to position itself impressively high within the international playing field. This is particularly applicable in matters concerning global competitiveness and economic freedom, which are areas where Estonia consistently receives high index scores. For prospective investors, this translates into a gold mine of opportunities backed by a reassuring level of economic stability and potential for growth.

Estonia's geographical situation is another valuable asset that presents unique opportunities. Nestled strategically between larger economies, Estonia offers a symbolic 'gateway' that links Western and Northern Europe with burgeoning Eastern markets. This strategic positioning can serve as a clear competitive advantage for businesses looking to access a diverse spectrum of markets, without the need for extensive logistical overhaul or excessive investment in infrastructural expansion.

A cornerstone of Estonia's allure as an investment destination lies buried within its key sectors of excellence. These are niches within the Estonian economic landscape where the country has managed to establish a particular level of expertise. Notable sectors include Information Technology, green energy, and advanced manufacturing. These sectors have seen substantial government support in the form of financial incentives. These incentives, usually packaged in the form of grants and loans, target research and development initiatives, innovative endeavours, and green energy projects. This not only fortifies the country's commitment to sustainable development but also presents enticing financial advantages for businesses keen on investing within these key sectors.

The Estonian government’s dedication is evident in the comprehensive and strategic manner in which it fosters a congenial investment environment. It consistently launches initiatives aimed at attracting foreign capital, nurturing innovation, and securing a long-term commitment to economic sustainability and growth.

Estonia's digital infrastructure is one of the most advanced in the world, offering a bedrock of advanced technological platforms that are primed to support a myriad of businesses. Besides, Estonia boasts one of the world's fastest broadband speeds and has a high penetration of technology adoption among its population. This digital sophistication forms an appealing backdrop to investors who are keen to ride on the global digital transformation wave.

Fiscal policy in Estonia is also tailored to suit investors. Known for its flat-tax system and the absence of corporate tax on reinvested profits, Estonia's tax environment presents a distinct advantage. This progressive tax policy, coupled with Estonia's transparent legal system and efficient bureaucracy, weaves together an investment climate that is both attractive and secure.

Foreign Direct Investment in Estonia

Opportunities for FDI in Estonia are varied and vibrant, extending across several sectors:

- Technology and Startups: Estonia is internationally recognized as a dynamic hub for technology firms and startups, thus offering promising opportunities for FDI in tech and innovation.

- Green Energy: Estonia's focus on sustainability opens avenues for lucrative investments in renewable energy projects.

- Manufacturing: The advanced manufacturing sector, with a significant representation in electronics and machinery, signifies notable potential for FDI.

- Biotechnology: On-going research and development in the life sciences provides excellent investment opportunities in biotechnology.

- Logistics: Given the country's strategic geographical location, investment prospects in logistics and transportation are solid and encouraging.

The investment and business landscape in Estonia morphs and evolves continuously, echoing the nation's commitment to innovation and global relevance. The regulatory requirements and compliance clauses embedded in Estonia’s FDI policy articulate its focus on efficiency, transparency, and strategic growth. This strategically places Estonia as a strong contender for global businesses looking to expand into European markets.

Business Banking in Estonia

It is not mandatory to make employee salary payments and third-party authority payments from an in-country bank account.

Generally, banks are open to the public from 9 am to 5 pm from Monday to Friday in Estonia. However, you can do most transactions online and more people choose to do so with 99% of banking transactions taking place online.

Registering a Company and Establishing an Entity in Estonia

Estonia is the first country in the world to introduce e-Residency, this is thanks to the country having the most advanced digital society in the globe. E-Residency allows anyone in the world to base their business and finances in Estonia and have full access to Estonia’s digital infrastructure. Foreign investors are also granted the same business rights as Estonian citizens.

Unlike many other countries in the world, a company can be registered and established by the private persons in Estonia within a few hours from nearly anywhere in the world. There are various types of business entities in Estonia, these include Private Limited Companies, Public Limited Companies, General Partnerships, Limited Partnerships, Sole Proprietorship and Commercial Association.

Private Limited Companies (OÜ)

This is the most popular entity among both Estonian residents and e-residents. Share capital is divided into private limited shares and is liable for the performance of its obligations with all of its assets, meaning a shareholder is not personally liable for the obligations of the company. Share capital must be at least €0,01 and there must be at least one founder of the company.

Public Limited Companies (AS)

This type of company is liable for the performance of its obligations with all of its assets, shareholders are not personally liable for the company’s obligations. Share capital must be at least €25,000 and there must be at least one founder of the company.

General Partnerships (TÜ)

The partners within this type of company will operate under a common business name and are mutually liable for the obligations of the general partnership with all of their assets. There is no minimum share capital and there must be at least two founders of the company.

Limited Partnerships (UÜ)

The partners within this type of company will operate under a common business name and at least one person (general partner) is liable for the obligations of the limited partnership with all of the general partners’ assets, and at least one person (limited partner) is liable for the obligations of the limited partnership to the extent of the limited partners’ contribution. There is no minimum share capital and there must be at least two founders of the company.

The Sole Proprietorship (FIE)

Arguably one of the simpler business entities in Estonia, a sole proprietorship is established by any natural person who opens a company on their own. The owner is fully liable for all debts and obligations of the company and must be registered with the Central Commercial Register before engaging in any business activities.

Commercial Association (Tulundusühistu)

This type of entity operates with a purpose to support and promote the economic interests of its members through joint economic activity in which its members participate. An association is liable for its obligations with all of its assets and members are not personally liable for the commercial association’s obligations unless otherwise agreed. If the articles of association do not provide for the personal responsibility of the members of the commercial association for the obligations of the cooperative, the share capital of the commercial association must be at least €2,500.

Visas and Work Permits in Estonia

EU Citizens

Citizens of the EU, the EEA and Switzerland can enter Estonia without a visa, however, if they wish to work in Estonia for more than three months, they must register as an Estonian resident in the Population Register of Estonia within the first three months of their stay.

Once registered, they will then have access to Estonian health insurance, social support and the right to many other public services. In order to register, the individual must present their personal ID (or a photocopy if sending by mail), a residence notice and a copy of a document proving their residence and their right to use the premises (for example, a tenancy agreement).

Non-EU Citizens

For non-EU citizens, the process takes slightly longer. Should an individual wish to work in the country for a short period of time (up to six months in a year), they have to apply for a D-Visa. Before applying, their employer must register their short-term employment with the Estonian Police and Border Guard Board.

D-Visa

This is a good option for anyone working on a short-term project in the country or if they want to start working as soon as possible. Visa applications can often take up to 30 days to be processed and they are only issued at Estonian representations that handle visa applications. The following information must be submitted when applying for a D-Visa:

- A valid travel document with at least two blank pages and valid at least three months past the expiration date of the visa

- An application form(in PDF format)

- A photo (35×45 mm)

- An insurance policy

- A document indicating the purpose of journey (for example, the short-term employment confirmation)

- A visa fee of €100

Should an individual wish to work in Estonia for longer than six months, they need to apply for a residence permit. They will first apply for a temporary resident permit, after having lived in Estonia for five years, the individual can then apply for a long-term residence permit.

Long-Term Residence Permit

The application for long-term residence should be submitted at least two months before the valid temporary residence permit expires and they must be submitted in person at the Police and Border Guard Board service office. The following information must be submitted when applying for a long-term residence permit:

- An application formwhich must be completed (in Estonian) on screen and then printed out

- A valid identity document

- A certificate of Estonian language proficiency

- A colour photo (40×50 mm)

- A document certifying your permanent and legal income during the six months preceding the submission of the application

- A document certifying the payment of the state fee (the amount will vary depending on the age of the applicant)

The individual will either be granted or refused long-term residence within three months of submitting their application, however no later than 10 days before their temporary residence expires. If long-term residence is granted, a residence card is issued to the individual within 30 days.

Income Tax in Estonia

The tax year runs from 1st January to 31st December.

Estonia has one of the most competitive tax systems in the globe due to its relatively low tax rates and lack of corporate income tax on retained and reinvested profits. In addition, taxes can be declared online alone.

Income Tax

Estonia is known for its proportional income tax system and the standard rate for everyone is 20%.

This flat rate means that income earners keep the larger portion of their salary for themselves, unlike other neighbouring countries such as Sweden and Finland.

Employers withhold taxes from employees’ gross salary each month, meaning there are no additional payments or filing obligations for the employee.

Residents of Estonia are liable to tax on their worldwide income, regardless of the origin of the income.

An individual is considered a resident of the country if their place of residence (the place they reside permanently or primarily) is located in Estonia or if they have lived in the country for at least 183 days over a consecutive 12-month period.

Non-residents are only taxed on the income they earn within Estonia.

Corporate Income Tax in Estonia

A tax rate of 20% (reduced to 14% for regular dividends) is applied to distributed profits and there is 0% tax on retained and reinvested profits.

CIT is payable upon profit distributions (the deemed profit distribution). CIT rate is 20%, calculated as 20/80 from taxable net payment.

Regularly paid dividends are subject to a reduced rate of 14% (14/86 from net dividends). Note: From 2025 a discount rate of 14/86 regularly paid dividends can no longer be used. This is one of the reasons why Estonia has ranked first in the ‘International Tax Competitiveness Index’ for seven consecutive years.

The tax period for corporations is a month, income tax must be returned and paid by the 10th day of the following month.

Social Tax in Estonia

Employers are obliged to pay social tax at a rate of 33%, 20% for social security and 13% for health insurance.

In addition, unemployment insurance must be paid on an employees’ gross salary at a rate of 0.8% and an additional 1.6% is withheld from an employee’s salary.

There is always a minimum monthly obligation for social tax to be paid, as of 2024, it is €725.

All Estonian registered employers must pay social tax on all payments made to employees, unless specifically exempt by law.

Funded pension

As of 1st January 2024, persons who have joined the II pillar will have the opportunity to increase their 2% funded pension contribution rate to 4% or 6% if they wish.

For this purpose, a corresponding application must be submitted to the registrar of the pension register or account administrator (1/01/2024–30/11/2024) and the new payment rate will apply from 1st January 2025.

Reporting Tax in Estonia

Depending on the type of business you operate, different taxes apply and therefore require different reporting timelines. However, the basic taxes most businesses encounter are income tax, corporate tax, and social security tax.

Monthly

- Federal Income Tax: Businesses are required by law to estimate income tax payments and remit them to the federal government regularly every quarter, which means that some tax payment is due on a monthly basis.

- Social Security & Medicare Taxes: Employers have to withhold part of the social security and Medicare taxes from employees' wages. These deposits must be made either semi-weekly or monthly, depending on the size of the payroll.

Yearly Obligations

- Corporate Tax: Corporations must annually report their income, gains, losses, deductions, credits, and figure their income tax using Form 1120, U.S. Corporation Income Tax Return.

- Social Security & Medicare Taxes: In addition to monthly deposit obligations, employers must report employees' wages and taxes to the IRS yearly on Form W-2, Wage and Tax Statement.

New Employees in Estonia

The hiring process in Estonia is relatively straightforward. All employees (unless they are an independent contractor) must sign a written work contract with their employer and this should be securely kept by the employer for at least a decade after its expiry. The contract should contain the below details:

- Employer and employee names, address and registry code

- The date of entry into the employment contract and the time of commencement of work by the employee

- Official job title

- Job description

- Workplace location

- Wage (in euros)

- Working hours

- Annual leave entitlement

- Notice period

- Workplace policies

- Other additional benefits

Despite English being commonly spoken in the country, all documents should be translated into Estonian e.g. in case of a labour disputes or if needed to be submitted to the authorities. Until the parties of the contract understand English, a translation of the employment documents is not needed.

Employers are responsible for ensuring employees are eligible to work in the country and can face a fine of up to €32,000 for not informing the employee in writing of the mandatory conditions of employment contract. EU citizens are permitted to work in Estonia provided they get a right of residency; however, temporary residents must have a work permit.

Normally, there is an up to four-month probation period for new employees. As a general rule, employment contracts are concluded for an unspecified period.

Leavers in Estonia

Should an employer have grounds to dismiss an employee, the notice period will depend on how long the employee has been with the company:

- Up to one year = 15 calendar days

- One to five years = 30 calendar days

- Five to 10 years = 60 calendar days

- 10+ years = 90 calendar days

In the event of gross misconduct, the employment may be terminated with immediate effect.

If an employee is dismissed due to redundancy, the employer must pay them one month’s average wage as a compensation.

If a fixed term contract is ended early due to redundancy, the employer must pay what the employee would have been entitled to.

If an employee has been with the employer for between five to 10 years, they are entitled to an additional one month’s salary from the Unemployment Insurance Fund.

If an employee has been with the employer for 10+ years, they are entitled to two months of additional salary from the Unemployment Insurance Fund.

If an employee wishes to terminate their employment contract, they must give their employer at least one month of notice. An employment contract may be cancelled during a probationary period by giving no less than 15 calendar days’ advance notice thereof.

Regardless of how the contract is terminated, the termination must be presented in writing.

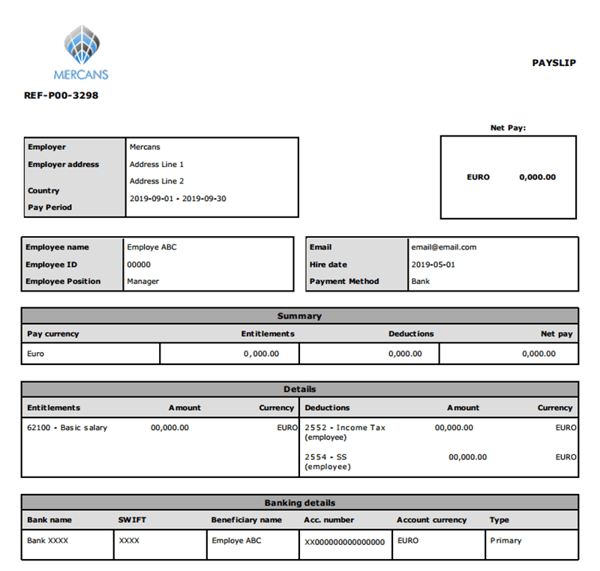

Payroll in Estonia

It is legally acceptable in Estonia to provide employees with online payslips.

Reports

Payroll reports must be kept for at least seven years.

Estonian Payslip Example

Employment Law in Estonia

Holiday Accrual and Calculations

Employees are entitled to 28 days of paid leave per year, this is often extended in the case of some professions, such as state and local government officials, teachers, academics and scientific staff.

Underage employees and employees with partial or no work ability are entitled to at least 35 days of paid leave per year. The 28 days of paid leave does not include the 12 public and national holidays listed below:

- New Year’s Day

- Independence Day

- Good Friday

- Easter Sunday

- Spring Day

- Pentecost or Whit-Sunday

- Victory Day

- Midsummer Day

- Restoration Independence Day

- Christmas Eve

- Christmas Day

- Boxing Day

Employees who work on public holidays may be compensated by time off or double pay. The working day before New Year’s Day, Independence Day, Victory Day and Christmas Eve is three hours shorter.

In some cases, holiday without pay may be granted by agreement of an employer and an employee and can be proposed by either party. During unpaid leave, the employment contract is suspended if the employee does not work at all during specific month. Unpaid leave is not included in the calculation of annual leave.

Maternity Leave

Women in Estonia are entitled to 100 days (14 weeks) of maternity leave and it’s duration is up to 70 days before the due date and up to 30 days after the due date.

If the maternity leave starts for example 31 days before the due date upon mother’s request, 39 days will be transferred to the shared parental benefit period, which can be used by both parents if desired.

Maternity leave is paid for by the Health Insurance Fund at a rate of 100%.

Maternity leave is only granted to insured women working prior to the leave. In order to receive maternity leave, expectant mothers must present a certificate issued by either a gynaecologist or family doctor.

A childbirth allowance is granted at a rate of €320 for a single child birth, in the case of triplets (or more siblings), the allowance is 1,000 euros per child (which totals to 3,000 euros in the case of triplets).

Paternity Leave

New fathers are entitled to 30 days of paid paternity leave, this can be taken at any point from 30 days prior to the due date up until the child attains three years of age.

This leave is paid for by the state and is based on income.

Parental Leave

After maternity and paternity leave ends, both mother and father can exercise an additional 435 days of paid parental leave paid for by the state.

This can be taken all at once by one parent or shared between both parents (only one parent at a time can be on leave). This has to be taken before the child reaches three years old.

Adoption Leave

An employee who is adopting a child will receive 70 calendar days of paid leave, commencing on the day the adoption ruling enters into force in one part or in parts within six months. The employer has the right to refuse to grant adoptive parent leave in a part shorter than seven calendar days.

Both adoptive parents have the right to adoptive parent leave at the same time for up to 35 calendar days. The leave is paid for by the Health Insurance Fund and how much an employee receives will be based on their average salary.

Childcare Leave

Either the mother or father has the right to take paid for childcare leave in each calendar year, this depends on the age of the child and is paid based on the average income (50% of it) of the parent on which social tax has been paid. The amount cannot be lower than minimum wage (€4.86 per hour as of 2024).

- One child under 14 years old = Ten working days

- Two or more children under 14 years old = Up to 30 calendar days in one year

For parents with a disabled child, one parent is granted an additional paid day off from work each month until the child reaches 18 years old. This is also paid based on the average income of the parent.

Both parents, who are raising under 14 years old child or under 18 years old disabled child, have right for unpaid child leave each calendar year for up to 10 working days.

Sickness Leave

Employers are required to pay sick leave from the fourth day of illness until the eighth day of illness. From the ninth day onwards, the Health Insurance Fund will pay the leave. Sick leave is paid at a rate of 70% of the employees’ salary from which the social tax is paid from the previous year.

Employees can be given a maximum of 182 calendar days of paid sick leave per year. In order to receive the leave, the employee must provide medical evidence that they are unable to work.

Study Leave

Employees are entitled to up to 30 calendar days of study leave per year to attend training. For any degree or job-related training, 20 days are compensated at the rate of the employee’s average salary. For the remaining 10 calendar days, the employee can take unpaid leave. In order to complete the training/degree, the employee is given an additional 15 calendar days of leave, this is paid at minimum wage.

The employee is entitled to notify the employer of the use of study leave not indicated in the holiday schedule at least 14 calendar days in advance in a format which can be reproduced in writing.

National Service

Employee has a right to refuse to perform work if the employee is in compulsory military service or alternative service or reserve service.

Annual holiday expiry is suspended for the period when the employee is conscript service or alternative service.

An employer may not cancel an employment contract on the ground that the employee is in military service, alternative service or reserve service.

Minimum wage in Estonia in 2024

Starting from January 1, 2024, the minimum wage will be increased to €820 per month. This represents a significant rise from the previous minimum wage of €725, marking an increase of €95 or 13.1%.

The hourly wage will also rise to €4.86.

Working Days & Working Hours in Estonia

For employees over the age of 18 years old, the working week is Monday to Friday, eight hours a day (40 hours a week – full time working time).

By law, working time cannot exceed 12 hours per day or 48 hours in 7 days period. Lunch breaks should last from 30 minutes to an hour.

Statutory National Holidays in Estonia 2024

There are multiple statutory holiday schedules within Estonia. Below are the statutory national holidays in Estonia for 2024.

| Holiday Name | Date | Weekday |

|---|---|---|

| New Year's Day | January 1 | Monday |

| Independence Day | February 24 | Saturday |

| Good Friday | March 29 | Friday |

| Easter Sunday | March 31 | Sunday |

| Labor Day | May 1 | Wednesday |

| Pentecost | May 19 | Sunday |

| Victory Day | June 23 | Sunday |

| Midsummer Day | June 24 | Monday |

| Independence Restoration Day | August 20 | Tuesday |

| Christmas Eve | December 24 | Tuesday |

| Christmas Day | December 25 | Wednesday |

| Boxing Day | December 26 | Thursday |

Employee Benefits in Estonia

Healthcare

One of the most important benefits for employees in Estonia is healthcare. All employees in Estonia are entitled to public healthcare which is paid for by their employer through social taxes. This comes into effect 14 days after the employee commences work and ends two months after their termination.

Some companies may offer their employees (particularly expats) private healthcare as the public healthcare service is often subject to lengthy waiting lists.

Other Benefits

Benefits vary from company to company, however some of the most common benefits include:

- Private pension

- Bonuses

- Company car

- Laptop

- Mobile phone

- Gym membership

- Stock options

Key updates for 2024 and 2025 in Estonia

In 2024 and 2025, Estonia is seeing several key updates in the areas of income tax, social security, and employment law:

Changes in Corporate and Individual Income Tax- Corporate Income Tax: The corporate income tax rate will be increased from 20% to 22% in 2025. Additionally, the preferential tax rate of 14% on regularly distributed dividends will be abolished from 2025.

- Individual Income Tax: A uniform basic tax exemption of €8,400 per year will be implemented for all individuals from 2025, replacing the current tax exemption structure. Certain tax exemptions and deductions will also be eliminated, including those for housing loan interest.

National Minimum Wage

- Starting from January 1, 2024, the minimum wage will be increased to €820 per month. This represents a significant rise from the previous minimum wage of €725, marking an increase of €95 or 13.1%.

- The hourly wage will also rise to €4.86. The increase in the minimum wage will have various impacts on employers and employees, including changes in the net salary for employees and the overall wage fund for employers.

Funded Pension

- As of 1st January 2024, persons who have joined the II pillar will have the opportunity to increase their 2% funded pension contribution rate to 4% or 6% if they wish.

- Applications need to be submitted to the registrar of the pension register or account administrator (1/01/2024–30/11/2024). The new payment rate will be in effect from 1st January 2025.

Implementation of Anti-Hybrid Mismatch Rules

- Amendments to the Income Tax Act will clarify the implementation of the ATAD2 Directive, addressing specific hybrid mismatch situations.

Obligations for Payment-Service Providers

- From January 1, 2024, payment-service providers will be required to store and report data on cross-border payments to the tax authority.

Introduction of Car Tax

- The Estonian Government is planning to introduce a car tax in July 2024 to encourage the use of more economical vehicles, though specific details are yet to be finalized.

These changes are part of Estonia's efforts to achieve a balanced state budget and enhance tax revenues. The amendments have undergone substantial changes during parliamentary discussions and are expected to play a crucial role in the country's fiscal policy in the coming years.

Notes

Please note that this document gives general guidance only and should not be regarded as an authoritative or complete statement of the law, regulations or tax position in any country. You should always seek specific advice for each specific situation. This document should not be relied upon as professional advice and activpayroll accepts no liability for reliance on its contents.

Want to learn more about payroll, tax, social security and more?

Register free today to get the latest up-to-date information on international payroll, tax, social security, employment law, employee benefits, visas, work permits and more.

Let’s Partner

Talk to a specialist today and find out how we support the growth of over 500 businesses with a range of activpayroll solutions designed to help your global payroll and people operations succeed.